Everything started for Starlink in 2014. Together with Greg Wyler, founder of WorldVu (now known as OneWeb), Elon Musk envisioned a constellation of 700 WorldVu relay satellites placed in low Earth orbit (LEO). Together, they could cover the entire area of the Earth with a broadband Internet signal.

The idea was very ambitious, since at the beginning of 2014, the largest constellation in orbit was Iridium’s, with only 66 satellites (which we talked about in the previous chapter). However, with the most valuable universal resource for delivering payloads to orbit — his own return rockets — Musk was the first to make it a reality.

From the first concept to the start of development

By mid-2014, Musk and Wyler’s business paths had diverged. In the second half of the year, SpaceX applied on its own to the International Telecommunications Union (ITU) through Norwegian regulator STEAM to register its satellite constellation. The US part of the business was called Starlink (this happened only in 2017), which was a reference to John Green’s sci-fi novel The Fault of Our Stars. The founders of the company were Elon and his younger brother Kimball Musk, along with SpaceX President and CEO Gwen Shotwell.

On January 16, 2015 at a private event at the Seattle Center Elon Musk made the first public announcement of plans to deploy the Starlink satellite constellation. At the same time, the world also learned bits of information about the future LEO constellation, which the businessman planned to spend $10 billion to deploy. It is worth noting that SpaceX was not the only company to see the prospects for communication satellites in low Earth orbit: also in 2014, One Web and Amazon both announced their own intentions to launch LEO constellations, each consisting of at least 1000 satellites.

According to SpaceX’s preliminary estimates, about 60 million people in the US alone live in areas which are difficult to access with fiber optic cable and who would be well-served by their new satellite internet service. The global market promised an even more impressive number of potential customers. Musk expected to earn from $30 billion to $50 billion, which would be used to finance the businessman’s most cherished dream – the creation of a base on Mars. Starlink was just a transitional step towards achieving this goal, and a potentially good test case for honing future Martian communications technology.

At the presentation in 2015, Musk revealed the first details about the orbit for Starlink satellites, which was originally supposed to be 750 km. He said that the full Starlink constellation will consist of no more than 4,000 satellites. At the same time, he announced tentative dates were announced for when exactly the Internet service would become active for users – no earlier than in five years.

Musk most likely assumed that in addition to the time required to develop so many satellites, it would take no less time to obtain a launch and broadcast license from the Federal Communications Commission (FCC). His fears proved well-founded, as it took until March 2018 that the broadcast license for the first 4,425 Starlink satellites operating in the Ku (12-18 GHz) and Ka (26.5-40 GHz) frequency bands was approved by the FCC. By November of the same year, the FCC licensed more 7518 satellites broadcasting broadband in the V-band (40-75 GHz). This license was revised at the initiative of SpaceX and was finally approved by the commission only in April 2019, valid for nine years from the date of issue.

Finally, SpaceX had the opportunity to escape from bureaucratic delays and focus entirely on developing their constellation.

Orbit Features: Why Starlink won?

This question is more difficult than it might seem at first glance. Indeed, before the advent of Starlink, satellite Internet already existed. What unique proposition was Starlink going to offer to its potential customers?

Beginning in 2003, the first broadband (Internet) repeater satellites were placed in Geostationary Orbit (GEO), about 36,000 km above the Earth. At that time, this was the clearly right way to go about it, since it allowed a single satellite to cover almost half of the globe with a signal. However, the farther from the Earth the spacecraft was located, the longer the signal took to reach it (and make it back to Earth). For end users on Earth, this was expressed in a greater signal delay (ping), and as a result, in a rather mediocre Internet connection speed.

The new generation of high-capacity satellites solved this problem in part. The ViaSat-1 (by Viasat), launched into geosynchronous orbit on October 19, 2011, had a capacity of 140 Gbps. The ViaSat-2 that followed in 2017, and which began broadcasting in February 2018, had an even higher throughput of 300 Gbps. He provided subscribers with a fairly strong connection speed (120–150 Mbps for download and 3 Mbps for upload) at a very competitive price: Viasat’s monthly plan started at $50 per month and went up to $300.

And yet, the altitude of the ViaSat satellites’ orbit hid many pitfalls which very soon made themselves apparent. Problems with two of the four ViaSat-2 receiving antennas were discovered in the satellite’s first year of operation, reducing its declared throughput from 300 Gb / s to 260 Gb / s. And Viasat could only come to terms with what had happened. Satellites in geosynchronous and geostationary orbits are very bulky and technically difficult to deploy, which affected the timing of their production and cost.

In 2013, four satellites (later to be joined by 16 more) of the O3b constellation made the first attempt to deorbit commercial communications satellites by placing them in Medium Earth Orbit (MEO) 8063 km above the Earth. This made it possible to significantly reduce the mass and technically simplify the communication satellites developed by O3b, which weighed only 700 kg each.

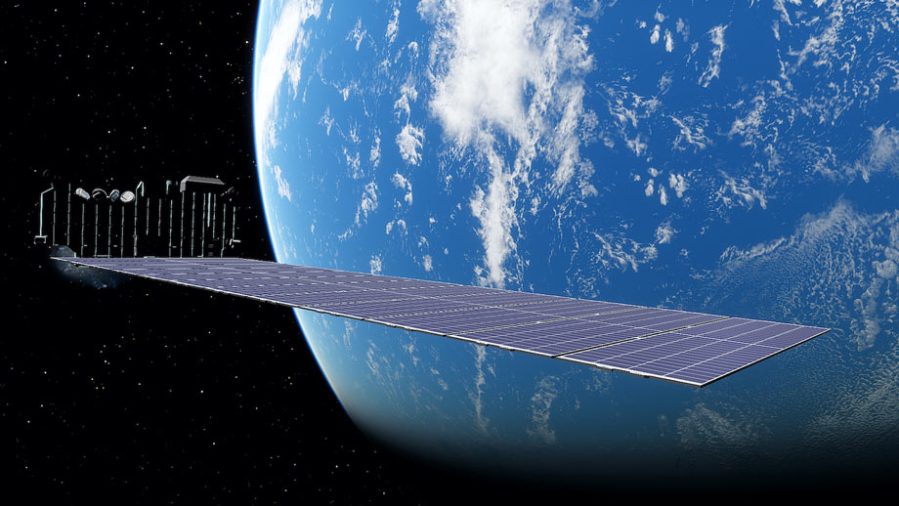

But for Starlink, even MEO was too high, so they made a bet on low orbit. Thus, the company chose three main high-altitude orbits (“orbital shells”) for the operation of constellation satellites:

- Very low Earth orbit (VLEO) – at an altitude of only 340 km. It was here that the fastest signal response was provided.

- Low Earth orbit (LEO) – altitude threshold 550-600 km.

- An orbit above LEO with an altitude threshold of 1150-1200 km above the Earth.

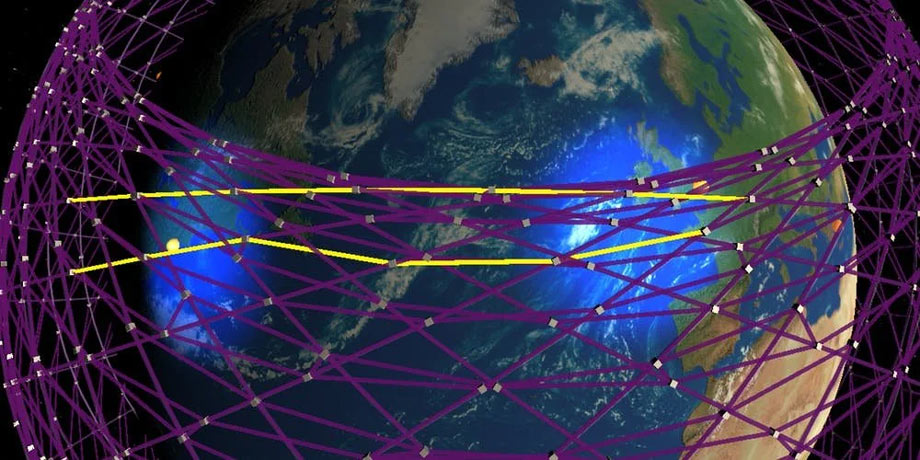

This distribution was necessary to organize a multi-layer communication system, which, while operating at different heights, would be able to quickly transmit a broadband Internet signal from satellite to satellite, and from satellite to user. In addition, the devices used different broadcast frequencies to ease the load on the signal reception and transmission channels. SpaceX decided to place satellites in each of the orbits sequentially, starting with the plan to fill LEO at a height of 550 km.

It is important to understand that all satellites in the Starlink constellation are in constant motion. This permanent movement in orbit allows Starlink to expand its area of satellite coverage, in particular to hard-to-reach areas, like mountainous and hilly regions, as well as lowlands. As it flies over the Earth’s surface, the angle of incidence of the satellite signal changes, allowing it to fill the entire terrain. Starlink’s model of satellite internet connection is organized much better than that of geostationary and geosynchronous satellites, which broadcast while remaining in a fixed position above the Earth.

Launching into LEO allowed SpaceX to significantly reduce the weight of their satellites, as well as simplify their design. As you might guess, this directly affected the cost of spacecraft. Although SpaceX has never officially released exact numbers, Shotwell and Musk said in 2019 that the price of a single satellite is well below $500,000. Many analysts agree that today one spacecraft may cost $250,000 to $300,000. Compare that to the $624 million price tag for ViaSat-2 and you can see why SpaceX chose low orbit. One ViaSat-2 hosted in GEO cost approximately the same as 2080 Starlink satellites in LEO. The returnable first stages of the Falcon 9 rockets made the process of putting them into orbit even cheaper.

The last argument in favor of LEO was speed. At an altitude of 550 km, the signal reached the end user on average 25-30 times faster than from a satellite located at an altitude of 36,000 km. The Internet latency numbers spoke for themselves: Starlink’s latency ranged from 20-40ms, while ViaSat’s (and similar communications satellites on GEO) ping was in the region of 594-624ms. And since SpaceX set out to make the world’s most sought-after satellite internet technology, choosing a low orbit was the only right decision.

Once the orbit concept was defined, SpaceX set about developing high-speed inter-satellite communications, and also began to think about how to most effectively reduce the risk of collisions, given its large number of satellites in orbit.

Inter-satellite laser communication and maneuvrability

To create a reliable topology for inter-satellite communication, SpaceX turned to the fastest medium in the universe – light. The speed of light, equal to 299,792,458 m/s, made it possible to transfer data from one satellite to another in a fraction of a second by communicating with laser inter-satellite links (LISLs). Put simply, this basically involves satellites shooting laser pulses at each other.

It is important to clarify here that not all Starlink devices use lasers to communicate with each other. The company’s first generation satellites used radio communication channels to transmit their signals. The very first probes using laser communications appeared only in January 2021, with the start of the launch of the v1.5 satellites.

It is now clear that SpaceX will remain on this “path of light,” and that laser communications will completely replace radio transmissions in future satellite versions. There are more than enough arguments for this transition.

The speed of light in the vacuum of space is much faster than in a fiber optic cable, since the photons encounter far less resistance. This is especially noticeable when transmitting a signal over long distances. The model below, built by Professor Mark Handley, shows that the delay for a laser transmission of a satellite signal from New York to London would be only 50 ms, while a fiber optic connection would be 40% slower at 70 ms. As the distance increases, the advantage provided by inter-satellite laser communication is even more obvious. Thus, the laser communication of London with Singapore would experience a signal delay of 90 ms, compared to 159 ms via fiber optic cable.

Laser communications provide a more than obvious advantage. The next challenge that Starlink engineers had to solve was the design of a remote avoidance system to prevent satellites from colliding with each other, since each of them moved in orbit at an average speed of ≈ 7 km / s.

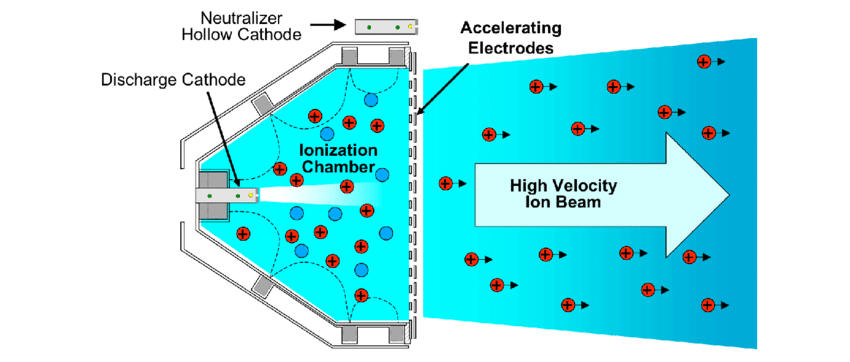

For orbital maneuvers, each Starlink is equipped with a single ion thruster (also known as a Hall thruster). The first generation of satellites used the inert gas krypton as fuel for their engines. Thrust in Hall engines achieved by bombarding neutral gas atoms with negatively charged electrons through a special electron gun. As it collides with electrons, the krypton gas loses positively charged ions, which are taken away with the help of a magnet and passed through negatively and positively charged accelerating electrodes, artificially accelerating the ions. The final process of neutralizing the dispersed ions by the cathode creates the final thrust in the engine.

Ion thrusters allow Starlink satellites to avoid collisions both with each other and with other space objects which it detects using space situational awareness systems. With the help of ion thrust, the satellites can also correct their orbit, and after a five-year operational period, the onboard power plant allows the satellite to leave the working orbit and burn out in the Earth’s atmosphere. SpaceX claims that the combustion process destroys 95% of the material from which the device is made.

Since SpaceX acquired nanosatellite company Swarm Technologies in July 2021, it has announced that the second generation of Starlink v2 (or Gen2) probes will use the inert monatomic gas argon as fuel. Perhaps, as it was moving to a new office, Swarm Technologies remembered to send out invites to its engineers responsible for the development of ion engines. As Musk himself noted, switching to argon as cheaper fuel was a difficult but necessary decision for the company. As a result, the new argon-powered ion thrusters are capable of producing 2.4 times more thrust and 1.5 greater specific impulse than the previous generation of krypton ion thrusters.

By equipping their satellites with ion thrusters and working in conjunction with the Star tracker optical navigation system, SpaceX seemed to be looking into the future. Over the next eight years, more and more satellite companies installed similar onboard thrusters on their probes. This included the Hall thrusters made by the Ukrainian company SETS, used on the EOS SAT-1, the first satellite of the EOSDA precision farming constellation. The latest report, Recommendations to reduce the amount of debris in the space industry, presented at the World Economic Forum in June 2023, obliged signatory satellite manufacturers to equip their spacecraft with similar onboard engines for better flight control and predictability.

Everything seemed polished and well-coordinated when it came to the spaceborne systems. But before proceeding with the deployment of the constellation, SpaceX had to solve their final challenge: developing and constructing compact, powerful, and at the same time inexpensive user terminals for receiving an Internet signal.

Starlink Dish receiving terminal

In 2019 SpaceX Services Inc. (a subsidiary of SpaceX) filed a license request with the FCC to operate 1 million ground receiving terminals. This was another unique element in Starlink’s satellite communications architecture. The terminals consisted of a modem and a compact lenticular receiving dish – a phase antenna array that receives a signal from thousands of satellites.

Their appearance was indeed futuristic.

Source: PC Mag, Credit: Brian Westover

However, the receiving antenna is made unique not by its appearance, but rather primarily because of its functionality. The Starlink Dish is a kind of computer, equipped with an ARM processor and RAM, with which the device works with SpaceX’s software. The software allows the antenna to automatically adjust to the best position for receiving satellite signals. For proper operation, the Starlink antenna must always point to the sky. Engineers also equipped it with a heating element to melt any snow which accumulates on the antenna.

Today, to ensure the best signal reception, the Starlink antenna should be pointed to the north in the Northern Hemisphere, and to the south in the Southern Hemisphere, since it is in these parts of the sky that the largest number of the constellation’s satellites is concentrated. However, as the satellite constellation grows, some of these rules may no longer apply.

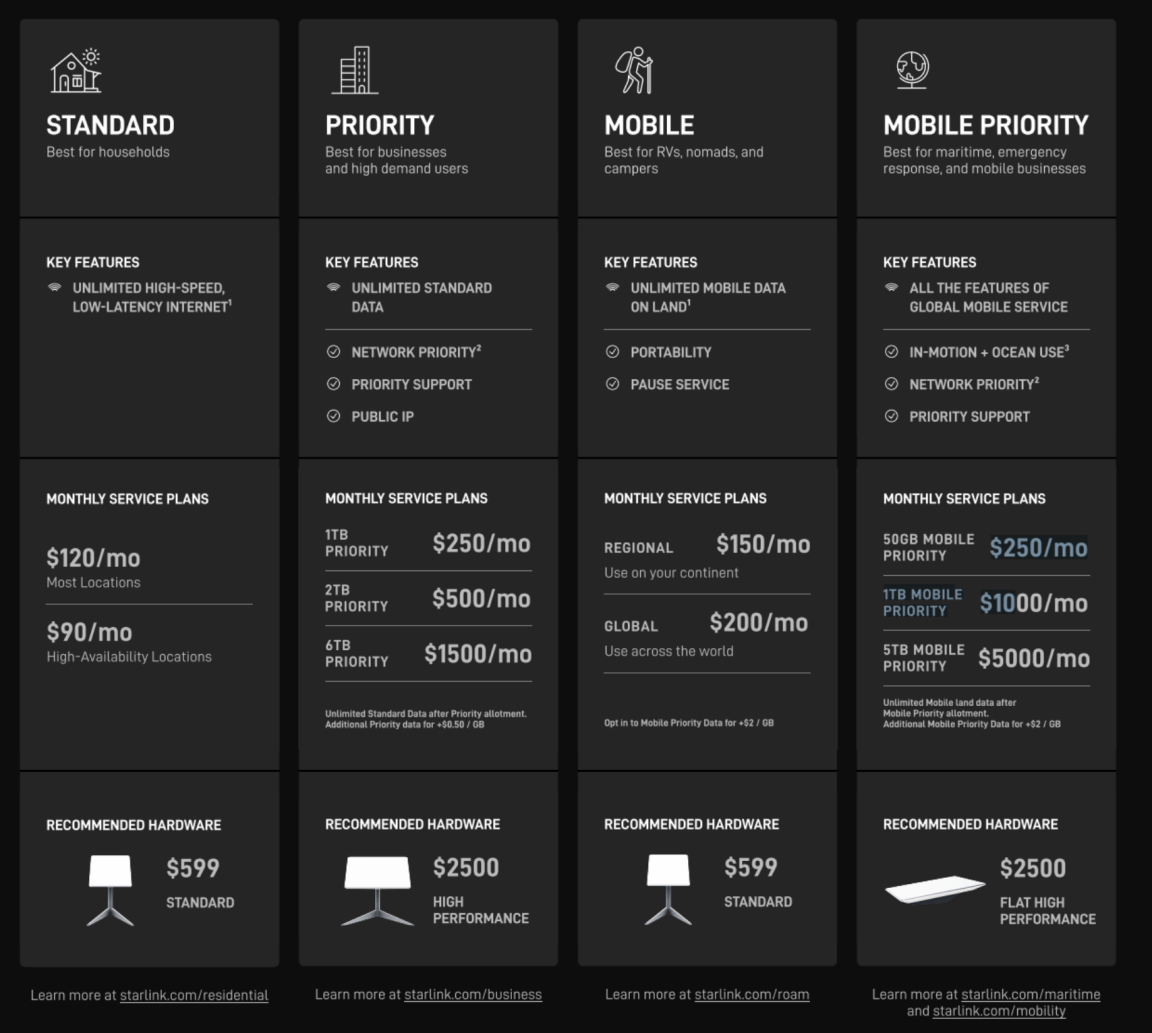

SpaceX sells the standard user version of its antenna for $599, but the company has a strategy to reduce the price for the user’s receiving terminal in the future. Currently, there are variations of the antenna for business, and in July 2022, the FCC allowed the use of antennas in vehicles, namely for shipping and commercial aviation. This is how the series of receiving antennas for the Starlink RV service appeared. As the size has grown, so have the prices – now one Starlink Maritime receiving antenna for ships costs $10,000 with a monthly subscription cost of $5,000. The company also offers mobile receiving terminals.

In the future, the company plans to reduce the size of their receiving plates to the size of an average laptop (0.29 × 0.25m/11.4 x 9.8 in). For comparison, the original $599 custom receiving antenna measures 0.51 x 0.24m, which is almost twice as long as the new model being developed. SpaceX has already filed an FCC application to obtain the appropriate manufacturing license.

There are also disadvantages, although they a matter not so much of Starlink’s antennas as much as of satellite Internet in general. Receiving terminals stop working when they experience external interference: the signal does not actually pass through the leaves of trees, and its quality deteriorates significantly even in rainy weather. In addition, the standard antenna (with the exception of Starlink Mobile) cannot be used on the move. Given the $599 cost of the receiving terminal and the monthly subscription fee, many potential customers are still in no hurry to connect to the service, waiting for Starlink to deploy a full constellation and be able to fulfill its promises regarding Internet connection speed for the user.

And now it’s time for the most important question.

Is it only a commercial internet available?

Yes and no. The historic first launch of 60 Starlink satellites (excluding test ones) occurred on May 24, 2019. From that moment on, the expansion of the constellation was unstoppable – by the end of the year, SpaceX announced that it would launch a batch of 44+ satellites into orbit every month in order to bring the number of satellites in the constellation to 2200 over a 60-month period. These promises were exceeded much earlier than the announced deadline.

Subsequently, SpaceX has evolved its business model and introduced a number of paid services that extend the functionality of the Starlink constellation to those who are willing to pay for it. For example, the Starlink for RVs access prioritization feature, for an additional fee, allows the user to skip waiting lists and connect to satellites without receiving a fixed address. Other paid services allow you to increase the monthly limit for downloading files and get higher Internet connection speed, again, due to access prioritization.

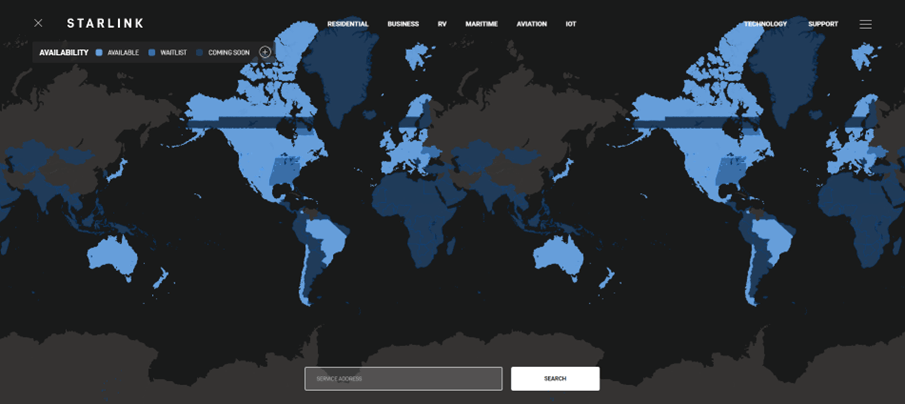

But even despite the many tricks that are typical for such a large service, there are steadily more active users: today Starlink has more than 1.5 million customers in 54 countries.

The rapid expansion of the Starlink subscriber base is does have its drawbacks for the company. For some regions, this “overcrowding” is the main factor ultimately leading to decreased Internet connection speed, with the number of simultaneous subscribers overloading all traffic. To solve the problem, SpaceX even had to take a number of forced measures, such as limiting the data download speed to 1 TB per month. But you can always pay extra to get more.

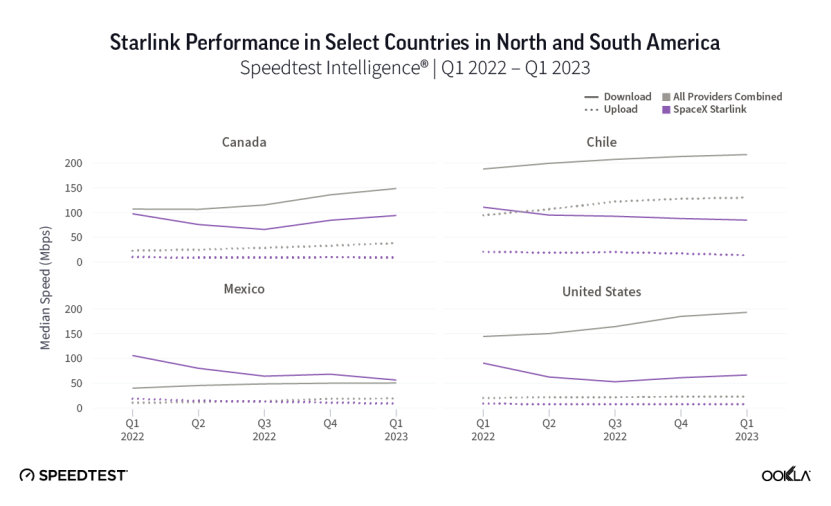

According to the speed tests by Ookla, for the 1st quarter of 2023 in some regions, Starlink has been experiencing a downward trend in connection speeds. The situation has improved somewhat compared to 2022, when most countries in which the service operated experienced a slowdown. The picture is now more stable, however, for some regions, connection speeds are slowly but steadily increasing, but others are experiencing a rather unpleasant drop.

SpaceX continues to assure its users that the gradual launch of more satellites will eventually solve these problems. But until this happens, people in regions with a lot of active subscribers will have to put up with slow download and upload speeds.

Ultimately, it is clear that the gradual deployment of the Starlink constellation, while moving towards its ultimate goal (providing global high-speed Internet), is subject to a flurry of fair criticism from its own users. At the moment, SpaceX is far from always able to provide people with the level of service previously promised. And perhaps if everything in this story rested solely on the civilian commercial Internet, SpaceX’s constellation would be less popular.

However, for Starlink, there is one factor that will guarantee its relevance for a long time to come. Interest from the Pentagon in the Starlink satellite constellation’s capabilities has given it new life and purpose. Civilian subscriptions have given way to national security priorities. Read about this in the final installment of our series.