The second quarter of 2023 continued the trends laid down at the beginning of the year. Thus, in the small rocket market, startups at the development and testing stage are not feeling confident enough due to pressure from large players, and investors are switching to satellite services, which have drawn such great interest from defense and other government agencies around the world. This state of the NewSpace market is a great opportunity for start-ups that provide components for propulsion, optical and SAR satellites, and develop their AI-based data processing solutions.

Analysts from Noosphere Ventures have assembled the main events of the first half of 2023 and studied the main trends in every niche of the space market.

Europe’s Rocket Dependence Is Not Decreasing

Temporarily without launch vehicles of its own, Europe intends to rely more on SpaceX to launch key scientific and navigational spacecraft while continuing to build its own launch capabilities. Despite its success, the latest launch of an Ariane 5 rocket on July 5 has left Europe temporarily unable to launch any more payloads into orbit. The rocket’s successor, the Ariane 6, is still in development and looks set to be ready for its first launch no earlier than 2024. After Russia’s invasion of Ukraine, Europe is no longer interested in the Soyuz. Vega C remains stuck on Earth due to an unsuccessful launch in December 2022, but its return to flight is expected at the end of this year.

Thus, the next European missions will use SpaceX rockets. The next one will be the Hera mission, scheduled for the beginning of 2024, which was supposed to launch on the Ariane 6 rocket. EarthCare, which switched from a Soyuz to a Falcon 9, is scheduled for the second quarter of 2024.

Of course, many European startups are looking to introduce reusable technology on their rockets. But so far, all these efforts remain early-stage, on-paper plans. In particular, Isar Aerospace has patented an airship-like design for its rocket’s first stage, with an engine designed to guide the rocket into a landing zone. PLD Space relies on parachutes for its design. Maia Space is trying to create a technology for landing its small rocket, but not so much for its own use, but for its sister companies in the Ariane Group. The development of these technologies will allow ArianeGroup to better meet the needs of the European Space Agency (ESA).

Investments in the rocket market

Perhaps the most significant event of the second quarter of 2023 was the bankruptcy of Virgin Orbit. The company’s main development was the LauncherOne rocket, capable of launching up to 500 kg of payload into low Earth orbit (LEO). Unfortunately, its latest failed test forced investors to withdraw their support for air launch development.

Four aerospace companies have bought property from Virgin Orbit to boost their own developments. Rocket Lab has allocated $16.1 million to lease Virgin Orbit’s main manufacturing facility in Long Beach, California, along with its machinery and equipment, in order to develop its Neutron rocket. Launcher, acquired by Vast, paid $2.7 million to lease the Virgin Orbit test site in Mojave, California, including its machinery, equipment, and inventory. Despite abandoning plans to create a launch vehicle after purchasing Launcher she abandoned plans to create a launch vehicle, Vast says that it will continue work on the E-2 rocket engine, which it developed itself in order to offer to other customers. Stratolaunch paid $17 million for the Cosmic Girl Boeing 747 launch air craft. And for $3.8 million, Firefly Aerospace decided to become the owner of Virgin Orbit’s remaining assets, namely shares in two of the company’s manufacturing plants.

Overall, venture capital investment in the small launch vehicle industry has declined significantly. In the second quarter of 2023, there was only one round of venture capital investment, as the American company Stoke Space raised an undisclosed amount of funding from In-Q-Tel for its plans to create a reusable vehicle capable of launching a payload of up to 500 kg into LEO. Checks from In-Q-Tel typically range from $250,000 to $3 million, with Stoke investments likely within that window.

Investors are becoming more selective, showing more interest in supporting category leaders that can offer short-term returns, as was the case in the first quarter of 2023, when Isar Aerospace raised $165 million.

In addition, an overheated market, a lack of significant technological progress in the companies’ development, and the distribution of venture financing among the main market players have also factored into investor choices.

Orbital transport

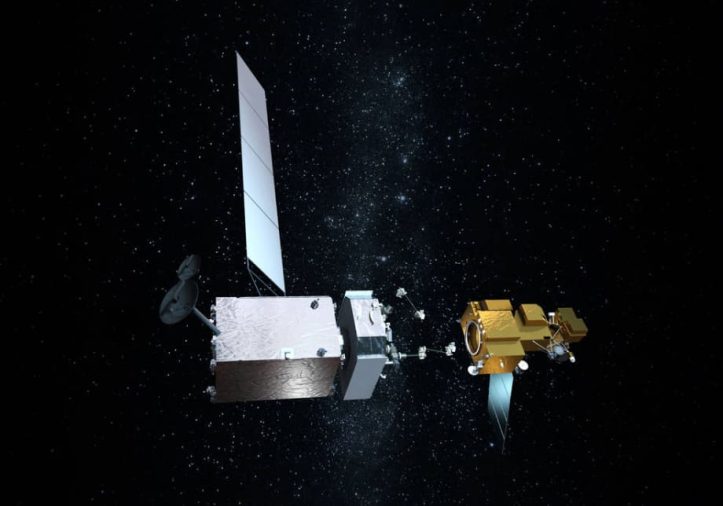

The market for orbital transport vehicles (OTV) is still overheated and is not bringing operators any new orders. Some companies in this sector are continuing to develop OTVs and gradually move from the R&D stage to product validation in orbit. Thus, three companies said they would launch their projects in the fourth quarter of this year, most likely as part of the Transporter-9 mission scheduled for the end of 2023.

There is still no commercial demand for in-orbit services, with only GEO satellite operators showing a bit of interest in life extension services for their satellites. In particular, Northrop Grumman received the only commercial order on the market for three Mission Extension Pods (MEPs): two for Intelsat and one for Optus from Australian operator GEO KA. The mission is planned for 2025.

However, a new major order has emerged from ASI – a $256 million contract for a consortium of companies led by Thales Alenia Space for an in-orbit servicing demonstration mission in 2026. There are no details yet, but the possibility of a wide range of services has been announced, including in-orbit refueling.

Four companies launched test satellites last quarter to try out technologies for future orbital service missions:

- Lockheed Martin (USA) launched two satellites in the fall of 2022, but has only now completed rendezvous and close (at a distance of 400 m) maneuvering tests.

- Infinite Orbits (France) launched the Orbit Guard (CubeSat 16U) satellite into GEO to demonstrate several technologies for future in-orbit maintenance missions.

- Starfish Space (USA) launched their Otter Pup, but due to a malfunction of its OTV Launcher (on which it was launched), the craft got a lot of initial spin, so it’s possible the Otter Pup’s mission will be completely lost.

- Turion Space (USA) launched its first DROID.001 space pollution monitoring satellite (SSA).

Three missions are already known which will have refueling take place in orbit. Thus, an ASI-funded test mission is scheduled for 2026, and an Orbit Fab mission to deliver 50 kg of hydrazine to GEO for the US Space Force should take place in 2025. Also scheduled for 2025 is NASA’s OSAM-1, a Landsat 7 refueling mission in LEO.

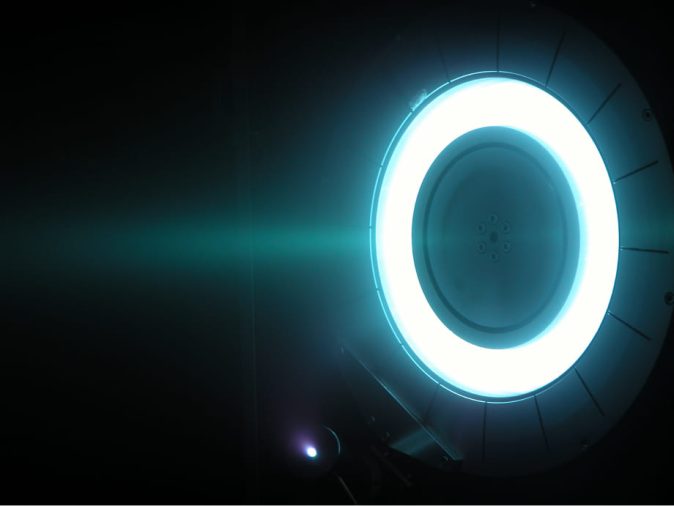

Space engine market

During the second quarter of 2023, several orders for electric propulsion appeared, mainly for small satellites. However, not a single contract for chemical propulsion was found, which clearly indicates the trends in this market and demonstrates the evolution of the approach to the creation of satellites.

The total potential of orders for engines just for the largest announced communication constellations of satellites — for Amazon (Kuiper constellation), Hanwha, European Satellite network, KLEO Connect, rivalry Space, and Telesat (Lightspeed constellation) is more than 6800. At the same time, only single orders have been announced, for a total of 16 engines for Exotrail, Sitael, Apollo Fusion and ThrustMe.

Three more companies have successfully completed testing of their propulsion systems in orbit, namely Exoterra, Bellatrix Aerospace, and Neumann Space. Together with SETS, which conducted successful tests at the end of spring 2023, we can already speak of 13 companies ready to supply space engines to the market.

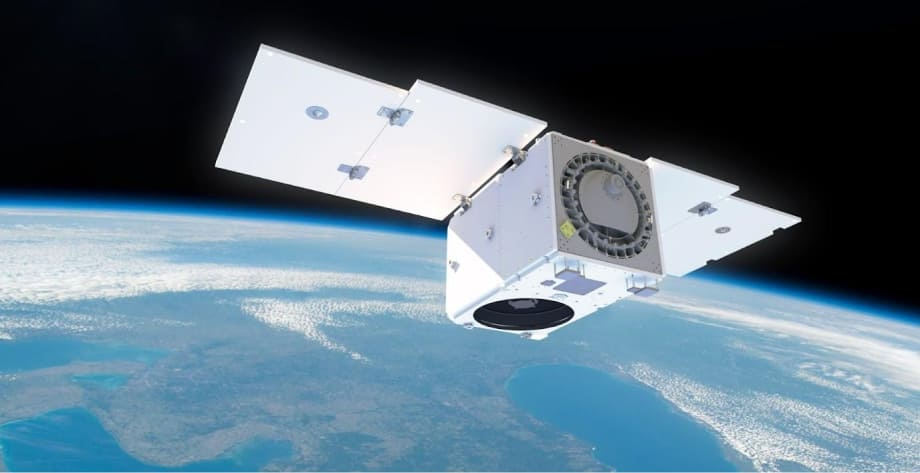

Satellites

Small satellites (SmallSats) for LEO continued to dominate the market in terms of orders in Q2 2023. During this period, five cubesats, 21 smallsats, and just one large satellite for geostationary orbit were ordered.

European companies are increasingly joining together in consortiums to jointly participate in national/government projects. Moreover, these consortiums include not only small companies, but also giants like Airbus, Thales Alenia Space, and OHB:

- A consortium led by Thales Alenia Space received a $254 million contract from ASI for a demonstration mission in 2026.

- The bidding consortium for the IRIS 2 project is a planned European Union mega-constellation of approximately 170 multi-bit satellites designed to establish reliable European space communications. The total cost of the IRIS 2 project is estimated at a whopping 6 billion euros ($6.6 billion). The EU plans to launch the first satellites by the end of 2024 and complete the creation of the constellation by 2027.

- A consortium led by Thales Alenia Space received a contract to develop the Space Factory 4.0 program, an interconnected system with facilities located throughout Italy, which should be operational by 2026.

- A consortium led by OHB wasbeen awarded a $98 million contract for the European Defense Fund’s ODIN’S EYE II project, which aims to develop a European multinational space-based ballistic missile early warning and tracking system.

In addition, European companies are beginning to expand their influence beyond the continent. For example, GomSpace (Denmark) is entering the US market through a partnership with SAIC, which will become the exclusive American integrator of GomSpace satellites. Creotech Instruments (Poland) is conquering the South Korean market in partnership with the South Korean defense company Hanwha Systems.

Optical satellite market

Backed by buoyant government demand, trends in the optical satellite market point to growth in company revenues. Optical earth observation and geospatial intelligence, along with increased demand for hyperspectral and thermal data, have led to an increase in revenue in the first quarter financial statements due to more government contracts. Companies are continuing to receive military and government contracts from US NROs and international defense agencies.

As an example, Planet Labs’ (NASDAQ: PL) total revenue is 31% higher than for the same period last year, as the company crossed the threshold of 900 data subscribers. Planet expects to generate $53 million to $55 million in revenue in the second quarter, which translates into 11% year-over-year growth in 2022.

One highlight was the acquisition of Maxar Technologies (NYSE: MAXR) by Advent International. Maxar will no longer be a public company and its shares are no longer being traded. Advent International acquired Maxar for $53 per share, bringing the corporate value of the deal to $6.4 billion.

Private investor interest in optical satellite operators has doubled compared to the first quarter of 2023. In the second quarter alone, eight companies raised an average of $15 million each from seed funding to Round B. Pixxel received the largest amount with $36 million, while the lowest investment haul was brought in by Hydrosat at $9.3 million.

At the same time, the requirements for such satellites, more specifically for images, have also changed. This first and foremost concerns the frequency of return visits, which should satisfy government customers.

Radar satellite market

Countries’ interest in radar satellites has not subsided, which encourages operators to develop and launch new constellations to meet these needs. Thus, in the second quarter, Iceye, Capella, iQps and UMBRA all increased their launch prospects.

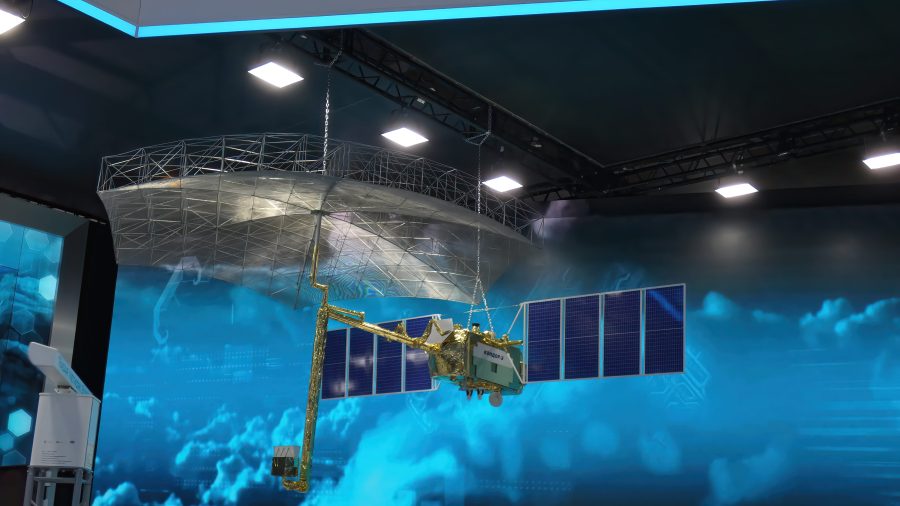

Russia launched its Kondor-FKA satellite with a 1 m resolution and 10 m bandwidth to detect Ukrainian military bases.

Data from SAR satellites is increasingly needed for military defense, disaster and critical infrastructure monitoring, maritime transport, finance, and insurance. In addition, companies have begun developing wildfire monitoring systems and other programs for early detection and response to natural disasters. Interest is growing for tools using artificial intelligence and machine learning to analyze information from many sources, including satellites, ground sensors and drones.

Lunar mission

NASA selected Blue Origin as another lunar lander developer for the Artemis mission. According to the aerospace agency, this will help provide competition with SpaceX, chosen in 2021, to send up astronauts more conveniently, safely, and cheaply.

Blue Origin will start developing its lander as part of a consortium that includes Boeing (providing docking), Astrobotic (cargo placement), Honeybee Robotics (responsible for unloading capabilities), Draper (Guidance, navigation, and control systems, as well as training and simulation), and Lockheed Martin (which will build a cislunar transporter spacecraft that will transport fuel from LEO to a halo orbit around the Moon).

Landing on the moon remains a challenge for today’s space industry. Thus, the first commercial attempt by Ispace (Japan) to land on the moon failed. A software glitch prevented the HAKURO-R lunar lander from correctly determining its altitude, causing it to crash during its landing attempt. The flight computer ignored the altitude information received from the laser rangefinder on the lander as it passed over a crater. This caused the lander to conclude that it was already on the surface, while it was still five kilometers above. The lander used software developed by Draper, but Ispace executives stated that the problems the lander experienced were due to requirements and parameters controlled by the mission control team. However, despite the failure of the moon lander, the company reached eight of the ten milestones set for this mission. This performance gives Ispace confidence in the prospects for its second lander under development, the M2, which is scheduled to launch in 2024. As a result of the M1 lander not completing its mission, Ispace will lose about $710,000 in customer revenue.

It should be noted that all the most recent missions to the Moon faced 3-6 month postponements of their first launch dates, as well as other troubles, such as lack of funding, technical problems, etc.

- Astrobotic’s first mission has undergone changes due to ULA launch issues, with an upper stage anomaly delaying the launch of their Vulcan LV. A new launch date is yet to be announced, but the flight is likely to take place no earlier than the fourth quarter of 2023. As for Astrobotic, the company has completed all the necessary tests and was ready to launch as early as January 2023. Apparently, the Puli Space Technologies lunar rover, which will fly aboard the Peregrine lander, is also delayed.

- Intuitive Machines has announced that its first moon lander mission has moved to Q3 23. The company said significant progress has been made in recent months on lander testing, including as structural testing to confirm that the vehicle is capable of withstanding the stress of launch, as well as a cryogenic tank demonstration. But there are still some functional tests to be done on the lander. The new schedule is slightly different from original expectations and could affect the schedule for the company’s second mission, IM-2, tentatively scheduled for the fall.

- SpaceIL has announced that several major donors to the Beresheet 2 mission have decided not to continue their investments in the project due to circumstances “not related to the organization and its partners,” according to local sources. Previously, donors had invested $45 million in a project aimed at landing two modules on the moon.

The main trends for space agencies

Representatives from NASA and Congress are still grappling with the fallout from the Debt Limit Agreement, which places a cap on spending. They acknowledge that this likely means the agency will receive less money than it asked for in 2024. However, the House Appropriations Committee has already approved spending of $826.4 billion for the US Department of Defense.(DoD) for fiscal year 2024, about $285 million more than the Biden Administration’s request. DoD spending on commercial space services remains modest despite growth in the Space Force budget. More and more startups are looking for contracts with DoD, while the National Geospatial-Intelligence Agency (NGA) is trying to forge closer ties with the commercial sector to address national security threats. Despite the growing interest in commercial satellite data, the industry faces uncertainty as the commercial market has developed opportunities faster than the government can react.

The EU is strengthening close cooperation with commercial companies in all sectors. This provides contracts for both big players and start-ups, primarily in the area of space debris removal (ESA with Airbus Defense and Space, OHB, and Thales Alenia Space, while CNES is interested in the Dark’s Interceptor system, designed to capture large objects of space debris, such as rocket hulls). However, EU leaders remain skeptical about whether the startup can successfully develop a small rocket given cost and market access issues, but see value in demonstrating the technology for possible future military use.

A report by PricewaterhouseCoopers and the UK Space Agency shows that the UK is now the most attractive country for private investment in space after the US. The main areas of investment are Earth observation, as well as the production of and connection to satellites. In 2022, 95% of investments went to income-generating companies, compared to 56% in 2015, indicating the sector’s growing maturity.

International Space Station

Russia has agreed to support the ISS together with the US until 2028.

Space exploration

The US is cutting its 2024 budget and has confirmed that deep space spending is far exceeding earlier estimates. Deep space missions may be delayed.

Partnership

South Korea and India have agreed to a closer partnership with the US. Australia has signed a technology safeguards agreement (TSA) with the US, creating an opportunity to transfer American space technology, including Australian-launched rockets and satellites.

After the start of the full-scale war in Ukraine, Taiwan has stepped up relations with Ukraine and EU countries. Taiwan wants to expand bilateral cooperation with the European Union in order to gain a foothold in the international arena and become less dependent on the United States.

Ukraine is expanding its space sector relations with the US by working on the Artemis program, and is also looking for opportunities in space with Malaysia.

Countries under sanctions

North Korea is working hard to develop various satellites, although the launch of its first reconnaissance spacecraft failed. Russia launched the Kondor-FKA satellite with a 1 m resolution. Roscosmos is recruiting fighters from among its employees for the Uranus battalion for the war against Ukraine.