Since the Sputnik-1 launch in 1957 space exploration was mainly driven by the arms race between the USSR (representing the Warsaw Pact socialistic block) and the US (leading the anti-soviet NATO block). The desire to dominate on Earth through controlling space was the next logical idea as technological progress and rocket engineering in particular produced ballistic missiles capable of carrying nuclear weapons.

The notorious Space Race to achieve military superiority became the symbol of the Cold War. First artificial satellites, Yuri Gagarin, Moon landing, Ronald Raegan’s ‘Star Wars’ initiative are among the brightest stories of that competition. Obviously, these projects were financed exclusively from the governmental budgets and were not commercially profitable in any way, nor were they meant for public consumption.

With the collapse of the Soviet Union, things have dramatically changed. Along with the political shift, we saw a drastic turn in space agendas that gave scientific and commercial projects a new peace-oriented course based on old defense developments. A few decades later, the New Space economy based on commercial companies’ effort and private capital flourished. If we talk about a commercial-based economy, that means it has to generate profit. So let’s take a look at the basics the New Space Economy stands on, the opportunities it opens, and try to foresee the future it brings. But first, let’s get on with the concept itself.

What is the New Space Economy?

The New Space Economy is a global trend powered by a bunch of technological innovations and a specific business model. According to Morgan Stanley, the $350 billion industry has the potential to reach $1 trillion by 2040. This trend opens opportunities for automotive, tourism, energy, telecommunications, space exploration, transportation, and other important industries to improve their on-Earth or space-to-space operations hence increasing profitability.

But its value is not limited to financial profitability. The concept of New Space is based on private investments that are made to produce both economic and social assets. Scientific and technological research programs are among the first to mention. New Space stands for new exploration, new technological demonstration, new innovative approaches, and new industries to revolutionize human interaction with space.

The structure of New Space Economy

Similar to how software development investment exploded in the nineties, the New Space Economy has the ambition to become the next big thing. The cost of operation is constantly decreasing, more startups are getting involved, and the space technology market boom lowers the last barriers that constrained investment influx.

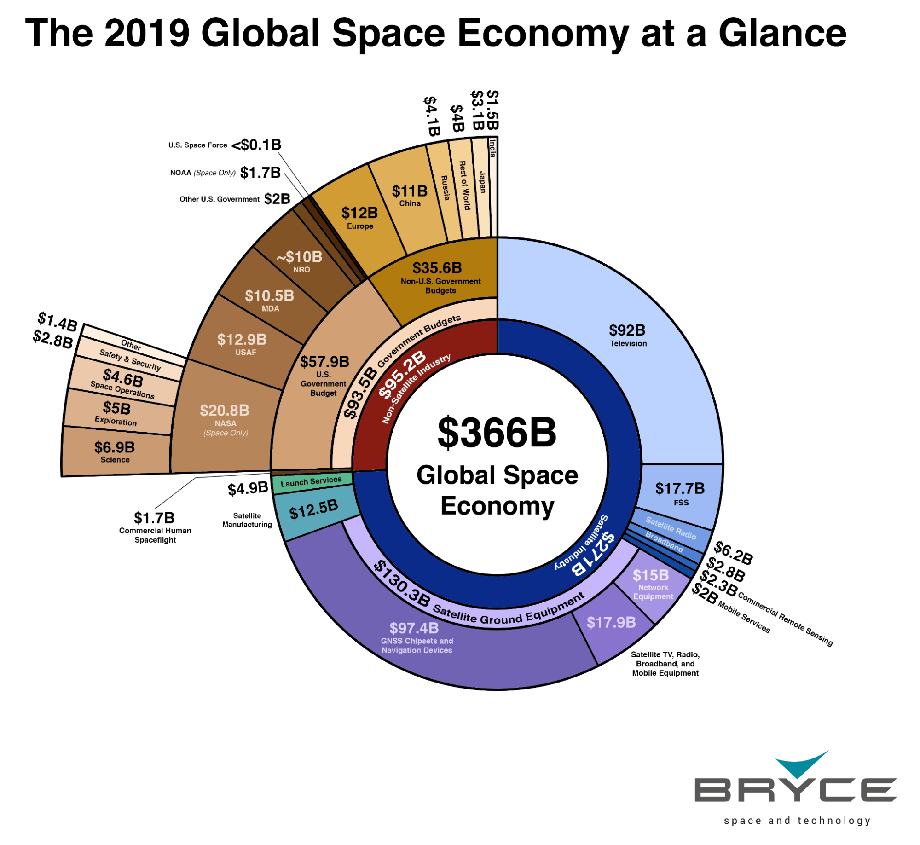

The main source of income the industry generates comes from the space-for-earth economy model. According to the Bryce Tech report, in 2019 about 75% of the global space economy was based on satellite-powered telecommunications, earth observation, internet networking, and navigation.

The New Space economy consists of a bunch of smaller industries, each having its own service monetization ways:

- Satellite production and launch

- Satellite internet

- Space exploration and research

- Lunar landing

- Earth observation

- Asteroid mining

- Space debris mitigation

- Space tourism

- Spacecraft manufacturing

- Cargo delivery

How do private space companies (plan to) make money?

Cargo delivery to the Earth’s orbit and beyond is now as sought after as ever. Private companies that specialize in cargo can have a big chunk of the New Space pie too. Earlier this year (2021), NASA awarded Firefly Aerospace around $93.3 million to deliver a suite of scientific equipment to the Moon in 2023 as a key part of the Artemis program. Firefly Alpha rocket is currently going through the flight tests stage of development. It is acknowledged that these vessels will have one of the best payload/price rates on the market.

Virgin Galactic has developed a spacecraft able to deliver six passengers to the edge of space for fun. For a couple of minutes in zero gravity, customers are ready to pay for about $250 000 per seat as the queue for the attraction is growing. Virgin Galactic also became the first space tourism company listed on the New York Stock Exchange in October 2019 as the company demonstrated confidence to find investments in the public field.

Its two main competitors in the tourism field SpaceX and Blue Origin are developing similar projects as well. Blue Origin came up and launched twice the New Shepard vehicle capable of transporting tourists to the Earth’s orbit and back for around $200 000 per ticket. Meanwhile SpaceX’s Starship vehicles, besides the ambitious Mars landing goal, are set to enable low orbit high-speed travel from different parts of our planet.

Governmental agencies tend to rely more on commercial parties. NASA cooperates with private companies in its attempt to end reliance on Russian Soyuz vehicles, for instance. A big part of that program, the Commercial Crew, awarded SpaceX for $2.6 billion and Boeing for $4.2 billion to develop astronaut crew capsules. Both SpaceX’s Crew Dragon and Boeing’s Starliner were successfully tested. The first even delivered humans to space and back twice.

The satellite industry is another huge commercial market. These services range from hardware manufacturing to connection provision. Many New Space participants are eager to tighten the telecom competition by delivering more satellite constellations – the networks of hundreds or thousands of small satellites to provide access to the internet. SpaceX, OneWeb, Amazon, and Telesat are working on delivering super-constellations in the upcoming years. The new networks will enable stable internet connection in areas with low internet penetration rates at an affordable price.

The most promising New Space areas

Growing climate change concerns. Space technology has the ability to help resolve environmental/sustainable issues. Satellite imagery is a great source of data needed to assess the environmental impact of human activity, predict changes, and come up with countermeasures. Satellite technologies are key for greenhouse emissions monitoring, renewable energy infrastructure planning, forestry health control, natural disaster management, and many other applications. Both private and public companies can fill the existing data gap as the demand for it is only going to grow.

Space junk. Mitigating orbital debris is going to be hugely important to ensuring the safety of orbital operations. Old spacecraft parts, pieces of junk, off-duty satellites that for some reason remain ‘hanging’ on an orbit are extremely dangerous. Because this debris is not ‘hanging’. It is, in fact, flying around the planet at a speed of tens of thousands of kilometers per hour. The European Space Agency’s statistical models estimate around 9600 tons of space junk. This includes 36500 objects greater than 10 cm and 330 million objects from greater than 1 mm to 1 cm. Remember that even the smallest parts can do great damage to spacecraft and satellites upon impact given the velocity they travel with. The number of launches and the number of active satellites will increase yearly, as well as the amounts of debris produced. Private companies have a great opportunity to capitalize on monitoring or removing orbital waste.

Communications and connectivity have been on the rise since the end of the seventieth when the first satellite television networks were established. However, satellite television is no longer the main driver of telecommunications development. Navigation systems for precise geospatial positioning and broadband internet service providers are currently having tough competition. Investing in additional satellite constellations might give companies an upper hand to dominate their markets. A bright example – Starlink. Establishing a cheap and accessible internet connection is, inter alia, one of the main investment goals for SpaceX. The company plans to spend over $10 billion on the project over the course of 10 years.

Developing space infrastructure is another potentially profitable area for space-to-space investments. Space infrastructure, research laboratories, habitats, factories based on 3D printing technology can and must be used for further space exploration. Axiom Space leads the field with their one-of-a-kind contract from NASA to design habitable modules for the international space station to stimulate commercial activity. Maxar Technologies was awarded $142 million to develop a construction tool for orbital deployment. These and other examples point out the governmental commitment to support private space infrastructure.

Concluding thoughts

It will take time for the abovementioned visions and developments to operate at full strength. Decades, in fact. Most of the questions for space economy development heavily rely on technological advancement which is hard to predict. There’s also enough room for economic and industrial improvement, as well for public financing, and many other fields that are shaping the future of the new space economy. For Earth, nonetheless, this industry will be instrumental to reach space and beyond.

The New Space Economy is a global trend powered by a bunch of technological innovations and a specific business model. Let’s take a look at the basics the New Space Economy stands on, the opportunities it opens, and try to foresee the future it brings.

What is the New Space Economy?

The New Space Economy is a global trend powered by a bunch of technological innovations and a specific business model. According to Morgan Stanley, the $350 billion industry has the potential to reach $1 trillion by 2040. This trend opens opportunities for automotive, tourism, energy, telecommunications, space exploration, transportation, and other important industries to improve their on-Earth or space-to-space operations hence increasing profitability.

But its value is not limited to financial profitability. The concept of New Space is based on private investments that are made to produce both economic and social assets. Scientific and technological research programs are among the first to mention. New Space stands for new exploration, new technological demonstration, new innovative approaches, and new industries to revolutionize human interaction with space.