Satellite telecommunications is a sector of the new space economy where companies provide customers with wireless signal reception and transmission services using orbital satellites as a transponder. Satellite communications and internet technologies like the Internet of Things (Internet of Things, IoT), DTH (Direct-to-Home) television, and high-speed data transmission over wireless optical communication channels are all becoming a part of our lives thanks to the work of SATCOM (satellite communication) companies.

Today, we will show you how satellite communications work and about the most exciting players in the SATCOM market. In addition, we will share a number of innovations in the field of satellite telecommunications which make our communication faster, more reliable, and cheaper every day.

How satellite broadcasting works and what it does

Satellite telecommunications are provided by two key types of equipment: ground terminals for signal transmission and reception, and relay satellites launched into low Earth orbit.

First, a radio frequency (RF) signal is sent from a ground station to a satellite. The satellite receives it, processes it, changes its frequency, and sends it back to the ground station upon receiving an incoming signal. Typically, the frequency at which the signal is sent to a satellite is higher than the frequency of the satellite’s transmission back to the Earth.

The satellite telecommunications market is usually divided according to function, consisting of four main areas:

- Backbone satellite communications: telecommunications infrastructure designed to provide communication services. Currently, satellite communications are being displaced from the backbone communications market by the development and deployment of fiber-optic communication lines, which have shown to be more reliable and profitable in the long term. The receiving terminals of backbone satellite communications aren’t very adaptable, as their antennas are fixed at a single location and are not transportable while receiving a signal.

- VSAT (Very Small Aperture Terminal) systems: “very small aperture” refers to the small size of the antennas which receive signals (1.8-2.4 m in diameter). VSAT-systems have low data transfer rates (2048 Kb/s) and are mainly used by companies which don’t require high bandwidth for their communication channels.

- Mobile satellite communications systems: a type of satellite communications in which the ground station receiving the satellite signal is not fixed in one place, but is rather able to travel from place to place. Mobile satellite communications are used in tourism, agriculture, and military activities, all of which depend upon the high mobility and compactness of their signal reception equipment.

- Satellite internet: used mainly in places that are remote and/or have underdeveloped infrastructure. A feature of satellite communications is the transfer of all client data mixed up, in a common stream. To filter the general data flow, client terminals installed on the Earth are used. The task of these devices is to sort incoming data and deliver it to the correct destination.

The equipment used for satellite signal reception is key to ensuring a high-quality process of receiving / transmitting data via satellite. It directly affects the speed of data acquisition, the ability to screen out background interference, and channel bandwidth. The SATCOM market for satellite signal reception equipment is divided by platform into:

- terrestrial: usually massive, permanent receiver terminals;

- portable: compact and easily mobile terminals;

- sea-based: receiving terminals responsible for maritime satellite navigation;

- air-based – receiving terminals responsible for aircraft satellite navigation.

According to a 2020 report from Marketwatch, ground terminals for receiving satellite communications were dominant in the market, making up 42.86% of all SATCOM equipment.

Frequency range of receiving and transmitting satellite signals

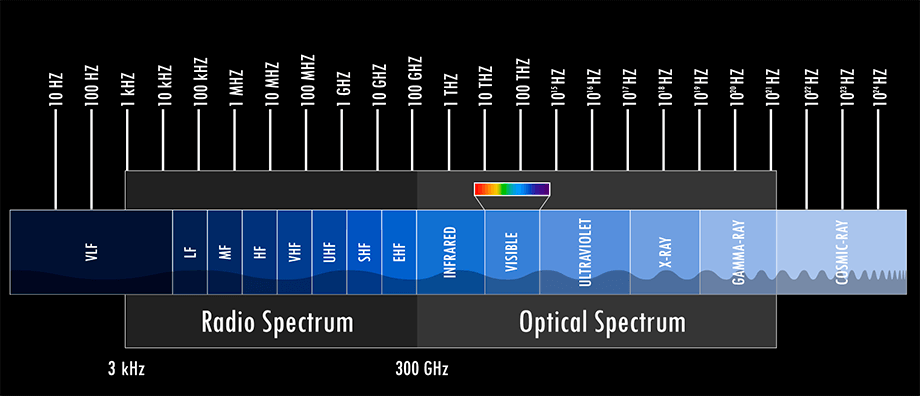

An important factor in the performance of SATCOM technologies is the frequency range in which satellites and receivers operate. The frequencies at which satellites receive and send information are not chosen arbitrarily. A satellite’s operating frequency is affected by the type of data it transmits, the size of the ground (antennas) and satellite (sensors for receiving and relaying the signal) equipment, as well as the absorption coefficient of RF transmission by the Earth’s atmospheric layer (the higher the frequency of the data transmission radio signal, the more the Earth’s atmosphere absorbs the radio waves).

The main frequency ranges of the satellites are indicated by letters.

*It is important to note that the bounds of frequency ranges can vary across scientific literature. This article uses the bounds set forth by NASA.

- UHF – 300-3000 MHz: has a long wavelength (100-10 cm), which allows it to be used in radar, radio, television, and cellular transmissions.

- L – 1-2 GHz: used to provide mobile satellite communications, satellite navigation, and digital transmission of audio and video signals.

- S – 2-4 GHz: used for mobile satellite communications. Most modern Wi-Fi routers and some radio stations work in this frequency range.

- C – 4-8 GHz: used to provide fixed satellite communications when the receiving ground station is stationary.

- X – 8-12 GHz: used in fixed satellite communications and wireless computer networks.

- Kᵤ – 12-18 GHz: used by direct broadcast satellites for broadcasting satellite television (direct-to-home, or DTH) and for some research satellites. For example, in the Ku-band there is a tracking data relay satellite (Tracking Data Relay Satellite) from NASA. SpaceX’s Starlink satellites also operate in the Ku-band.

- K – 18-27 GHz: used by spacecraft to operate Earth/space communication equipment and radar.

- Kₐ – 27-40 GHz: used for high-bandwidth satellite communications. The Kₐ band is set to be used in Amazon’s Kuiper satellite constellation (a formation of many small satellites flying close together and aimed at a particular mission) in low Earth orbit (LEO). The recently-launched James Webb Space Research Telescope also operates at this frequency.

- Q – 40-50 GHz: used primarily in inter-satellite communications and in radio astronomy research. The QUIET telescope, which studies the polarization of cosmic microwave background radiation, operates in the Q-band.

There are also the V (75 GHz) and W (80-90 GHz) frequency bands, but their wavelength is so small that these frequencies cannot pass through the atmosphere. Therefore, these ranges are usually used for high-bandwidth terrestrial communication.

An unfortunate disadvantage of RF data transmission is its susceptibility to background interference caused by the significant distance between the satellite and the ground signal receiving terminal. Large distances between the equipment for receiving and transmitting a signal contribute to the formation of a high propagation delay (ping). The greatest signal delay is typical for satellites in geostationary transfer orbit. The problem is solved with the use of satellite constellations placed in low earth orbit, where the distance between the transmitter and the receiver does not cause such a noticeable signal delay.

It should be noted that modern satellite technologies are not limited to working just in the radio frequency range. Optical inter-satellite links (OISL) use lasers to transmit data. The optical range of signal transmission has a number of qualitative differences from the radio frequency range, since it is unregulated. As a result, SATCOM companies do not need to obtain regulator permission to use OISL from the countries to which satellite broadcasting is carried out.

Optical inter-satellite and satellite telecommunications open a direct path to the widespread integration of the Internet of Things, an automated global network that minimizes human participation in the processes of receiving, transmitting and processing data.

The development of 5G networks and the role of satellites

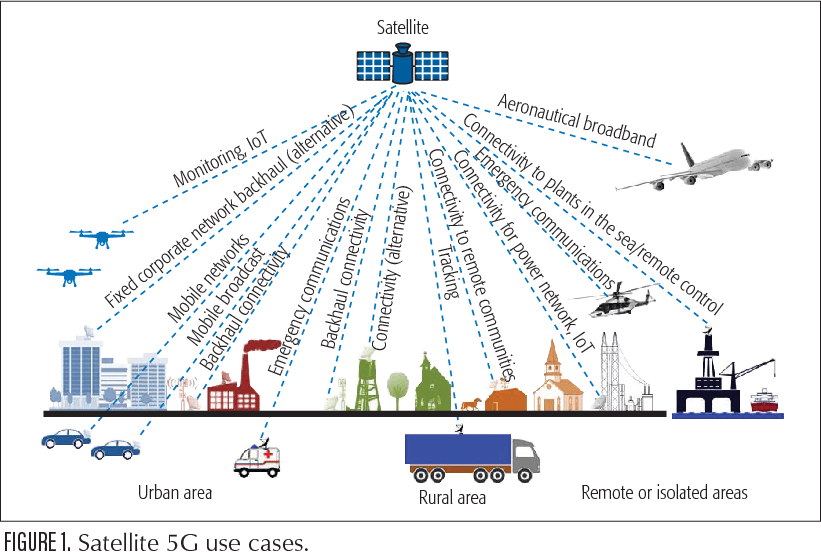

Today, the rollout of 5th-generation (5G) cellular networks is the main force driving the growth of the satellite telecommunications market. By the beginning of 2022, more than 1 billion people are expected to live in areas with 5G coverage.

The key advantages of 5G communication include high bandwidth of communication channels, high connection speed, and low delay in the area of signal reception and transmission.

5G is expected to bring a real technological revolution in many areas of public life, from improving the logistics of unmanned cargo transportation to deep integration of the Internet of Things, from improving the quality of satellite monitoring of the Earth’s surface to the proliferation of telemedicine. But in order for this to become a reality, humanity needs to be building up its 5G infrastructure right now. This includes the creation of new satellite constellations (mainly in LEO) and ground terminals for receiving and transmitting signals, which will provide 5G coverage in all corners of the world.

The advantage of satellites over ground transceivers in providing 5G coverage is that satellites can provide network coverage in areas where it’s not possible to construct cellular towers. Satellite telecommunications are not tied to individual regions with a developed terrestrial infrastructure, which increases flexibility in creating networks of safe and reliable high-speed communications.

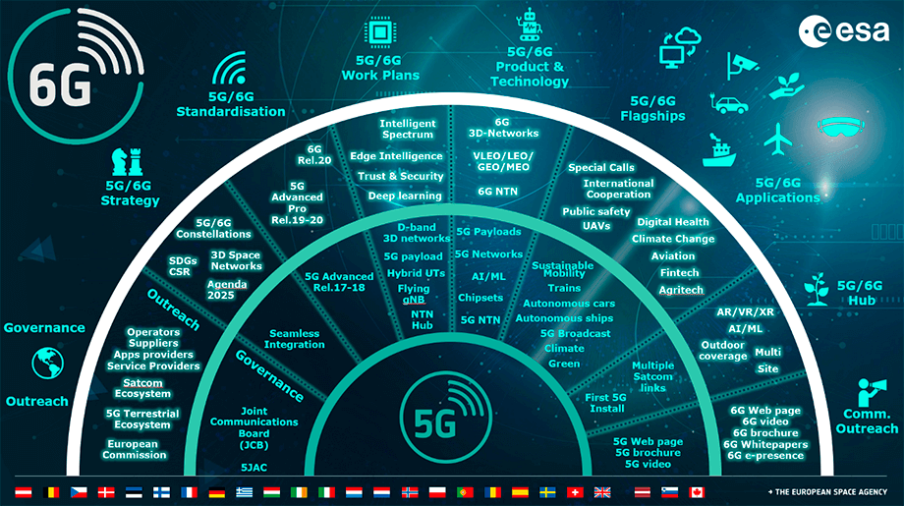

At the Space 19+ESA (European Space Agency) conference, the new Space for 5G strategy was approved. It calls for increasing the level of business digitalization at the national level with the support of a number of European countries and partners participating in the program.

ESA’s 5G development and deployment strategy aims to advance the position of the satellite market in this area. In addition, Space for 5G is focusing its efforts on creating common communication standards for 5G-compatible satellite networks. The Space for 5G project and the organizations that oversee it are also collaborating with 3GPP, a consortium developing global specifications and standards for the telecommunications market.

As part of the Space for 5G program, the 5G-Hub research and development center was created on the Harwell campus in Oxfordshire, UK. The main goal of this hub will be to conduct research to test the possibility of integrating 5G satellite communication systems into SATCOM. Separate projects in the 5G-Hub are already working on the development of sixth-generation communication systems, 6G.

The integration of satellite technologies in 5G networks is driving the development of the Global Navigation Satellite System (GNSS). ESA is already investing heavily in its European GNSS Evolution Program, which aims to create an automated wireless navigation network for unmanned vehicles and drones.

Key companies and promising startups in the SATCOM market

Now let’s talk about the companies which focus on the development and implementation of SATCOM-technology in our daily lives.

We have compiled a list of SATCOM companies doing big things in the market. It includes both the market veterans and ambitious up-and-comers most active in 2021.

Celestial Space Technologies

Celestial Space Technologies is a German company working on creating a communications system between the Moon and the Earth based on a “constellation” of relay satellites (in the long term). In the short term, Celestial Space Technologies is aiming to create a communications system in low Earth orbit. Celestial’s innovative ground receiving terminals are integrated with 5G and IoT networks, meaning they can be put to use in logistics and cargo transportation, as well as to provide satellite navigation.

Scout

Scout is an American company based in Alexandria, Virginia. It is creating the first systems for monitoring and maintaining the health of satellite equipment in space. In addition, the company is developing its own space traffic monitoring network.Scout monitoring equipment can be both installed on satellites and launched into orbit on its own, carrying out remote observation of the status of several dozen satellites at once. And although the company does not directly provide SATCOM services to consumers, a number of satellite communication providers will definitely be interested in its services.

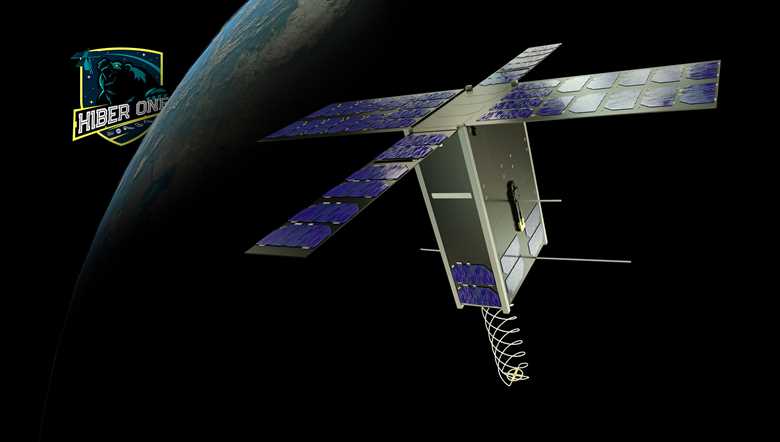

Hiber

Hiber is a startup from Amsterdam which generated some of the biggest buzz of 2021. The company aims to create the world’s first Low-Power Global Area Network (LPGAN). It uses tiny nanosatellites launched into LEO. Currently, applications created by the Dutch startup are monitoring crops in Africa, observing water channels in Australia, and guiding fishing boats in the Pacific Ocean. Constellations of Hiber satellites can even observe the Netherlands’ iconic tulip fields from space, providing the most up-to-date data on the state of field ecosystems and irrigation canals. The company’s goal is to create an accessible and affordable network for connecting to the Internet of Things in the most remote and hard-to-reach corners of the planet.

In 2020, Hiber received a large vote of confidence from the European Innovation Council in the form of a €278 million grant, and will receive direct investments in its equity capital in the future.

Telesat

Telesat is a company from Canada that has been providing satellite telecommunications services to its customers for over 50 years. It works with wireless satellite internet, the creation and maintenance of closed corporate communication networks, the provision of sea and air navigation services, as well as satellite television. In addition, Telesat provides satellite relay services to two Canadian digital broadcasters: Bell Satellite TV and Shaw Direct. The company’s experience and stability in the SATCOM market allows it to advise satellite operators and other interested players around the world.

Dish Network

Dish Network is an Englewood, Colorado-based company that has long been a major player in the US satellite TV market, but is now betting on a 5G network that will eventually provide broadband coverage to more than ⅔ of the US population. This year, Dish Network stepped into the forefront of SATCOM companies, becoming the fourth largest 5G provider in America. In addition, the company has entered into a three-way deal with telecom operators Sprint and T-Mobile, and already has a working strategy to build up its satellite infrastructure through 2023.

Viasat Inc.

Viasat Inc. is another veteran of the SATCOM market. The California company, founded in 1986, provides broadband satellite communications services to both civilian and military clients. Its business is segmented into three main areas: government communications systems, commercial enterprise networks, and private sector satellite services. Viasat’s Inc. commercial networks division is responsible for the building of modern satellite broadband and wireless platforms and is working on developing integrated circuits used in space/Earth communication systems.

Gilat Satellite Networks

Gilat Satellite Networks is an Israeli company specializing in the development of terrestrial satellite VSAT terminals. GSN has its own extensive telecommunications satellite network between central stations and geographically-inaccessible peripheral regions. Their product offerings include modems, transceivers, block converters, and satellite signal amplifiers, as well as a variety of mobile antennas for signal reception. The company works not only with satellites, but also with fiber-optic communication lines. GSN has been on the market for more than 30 years, and during this time has gained considerable popularity far beyond Israel.

EchoStar

EchoStar is a Colorado-based company founded in 1980. Today it is a telecommunications holding operating through two subsidiaries: Hughes Network Systems and EchoStar Satellite Service (ESS). Hughes Network Systems provides broadband satellite communications services and creates local data exchange networks for structure analysis and international customers. EchoStar Satellite Service cooperates with public sector clients and provides satellite communications services to TV news agencies and streaming platforms. EchoStar is one of the strongest players in the global SATCOM market and has a leading presence in North America, the Middle East, Asia, Europe, Australia, and some parts of Central and South America.

SATCOM market forecast in the near term

According to a report published by Verified Market Research, the global satellite communications market was estimated at $65.68 billion in 2020. Its average annual growth is 9.1%. By 2028, the SATCOM market is set to have doubled in size to $131.68 billion.

The main players in the SATCOM market are EchoStar Corporation, SKY Perfect JSAT Group, L3 Technologies, Inc., SES S.A, Telesat, Intelsat, Viasat, Inc., Gilat Satellite Networks, Cobham Limited and Thuraya Telecommunications Company.

The leading drivers of market growth are the use of the Internet of Things and the development of the 5G satellite sector. IoT in the aviation industry is expected to greatly automate the field of air navigation and heavy traffic management. The interaction of satellite services with the internet will be tied to the use of high-speed broadband satellite data transmission, the development of which also portends a favorable climate for the growth of the SATCOM market.

On the other hand, as the market grows, there will be a significant increase in the consumption of ground equipment for sending and receiving signals in areas with underdeveloped infrastructure. Defense departments still give preference to satellite communication systems due to their mobility and high degree of encryption (with modern satellites that transmit data via optical satellite communication channels). Government structures are also showing interest in the innovative field of OILP data communication, which guarantees the stable public investment in research and the use of technology in the future.

The main hindrance to the growth of the satellite telecommunications market today is growing competition from companies providing more affordable and cheaper fiber optic communication services. This competition has been weakened by the constellations of satellites that many space giants, such as AWS and SpaceX, are currently placing into lower Earth orbit.