As we get well into the 2020’s, the space services industry is on the rise. The entry of private commercial companies into the market has opened up a wide range of new opportunities for tourism, business, and even environmental protection.

Today, the space services industry is one of the most well-developed areas of the new space economy. Suborbital tourism, the market for streaming services and the high-speed data transmission they require, satellite monitoring, and the exploration of new natural resource deposits are all benefits produced by companies providing commercial services in space.

This article is about the most dynamically developing space services, companies that provide such services, as well as the near-term financial prospects of the space services market.

Satellite services and their purpose

Satellite-as-a-Service (SaaS) is a field of the space services market which provides customers with access to satellite data exchange technologies, mostly on a subscription basis. Customers in the satellite services market include telecommunications companies and DTH (Direct-to-home) operators that provide streaming services.

The main advantage of SaaS is that there is no need for the client to invest in the process of creating and launching satellites, since they have already been launched into orbit, and the customer simply leases their production facilities.

The satellite services market can be divided into five main types:

- Consumer services: satellite TV and radio broadcasting, along with broadband communications.

- Fixed satellite services (FSS): companies that provide access to services for the operation of ground equipment for receiving and transmitting data.

- Mobile satellite communications: provides network coverage for mobile operators.

- Remote sensing and monitoring of the Earth: focused mainly on things like forecasting natural disasters, meteorological observation, and exploring natural resource deposits.

- Space flight control services: launch and control facilities which offer their services to space and suborbital transport firms which don’t have their own such infrastructure.

Consumer service and mobile communication satellites are a topic for another time, but for now we will focus on the other three areas of the space services market.

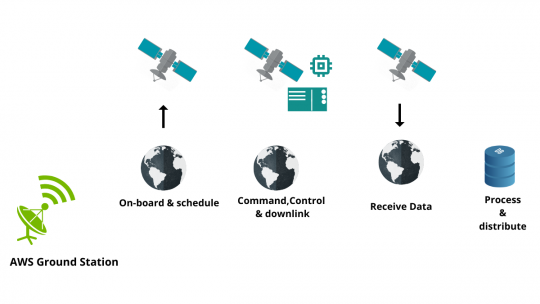

Ground terminals for satellite control

Information received from satellites is processed by ground stations, which are Earth-based terminals for monitoring and data management. Ground stations are able to program a satellite by transmitting parameters and commands. After receiving this information, the satellite sends it to the receiving antenna of the ground station, after which the operators begin to process the information. This diagram from Amazon Web Services (AWS) shows how this model works for them.

In order to receive high volumes of satellite data and process it promptly, it is critical to have enough ground terminals at work. That is why Amazon has been stepping up its construction of ground stations lately. They have recently launched two new stations in Ohio and Oregon. AWS’s most prominent customers are Capella Space, Digital Globe, D-Orbit, and Thales Alenia Space.

Amazon’s closest competitor in the market for satellite ground stations for receiving satellite signals is another American company called Kymeta, headquartered in Washington state. Kymeta has made a bet on its ability to offer light, portable terminals, resulting in their compact U8 electronically-steered antenna. The U8 portable terminal is capable of receiving data in the entire Ku-band (12-18 GHz), and in the future they will be able to work with the frequencies of satellites in LEO (low Earth orbit). The company was able to more than double their antenna gain from previous models, resulting in extremely low scan noise. Kymeta’s U8 ground station does not need to be pointed at the satellite it is receiving from in order to get a signal. Kymeta offers an even more compact and transportable version called the U8 Go.

Kymeta’s business model is also impressive. The company offers access to all necessary ground equipment through a Kymeta Connect subscription. This strategy allows Kymeta to cash in on a rather large market of customers who are in need of ground station data processing services but who are not themselves ready to purchase their own ground equipment.

Satellite monitoring: from hunting for natural resources to pinning down natural disasters

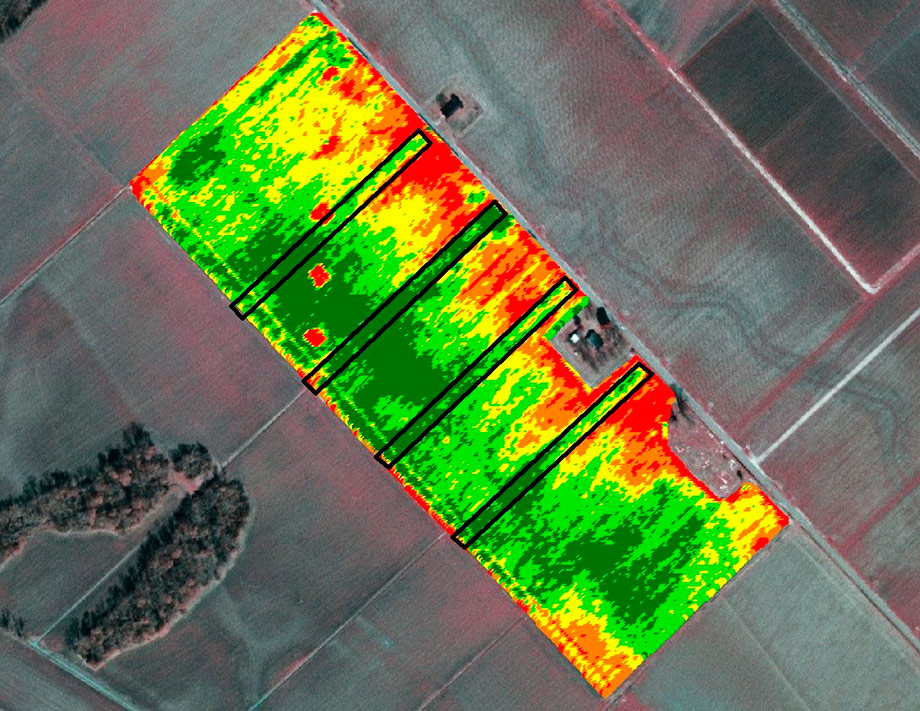

Another service which SaaS companies provide is satellite monitoring, whereby satellites provide regular scans of the Earth’s surface. Satellite monitoring involves collecting and comparing data about points on the Earth’s surface for subsequent analysis and forecasting of things like climate change, harmful emissions into the atmosphere, and mineral exploration.

One of the most ambitious approaches in this regard is the analysis of the earth’s surface using satellite-created GIS (Geographic Information Systems) maps. Landscape analysis with GIS maps opens up a wide range of opportunities in areas such as agriculture and forestry.

The high resolution of satellite images (30 cm per pixel) allows analysts to track the dynamics of changes in ecosystems and predict the level of danger of natural disasters to ensure proper preparation, mitigation, and timely response for emergencies. Satellite monitoring also makes it possible to carry out geological analysis of soil to search for new mineral deposits. Currently, GIS mapping services are provided by companies such as EOS Data Analytics and Satellite Imaging Corporation.

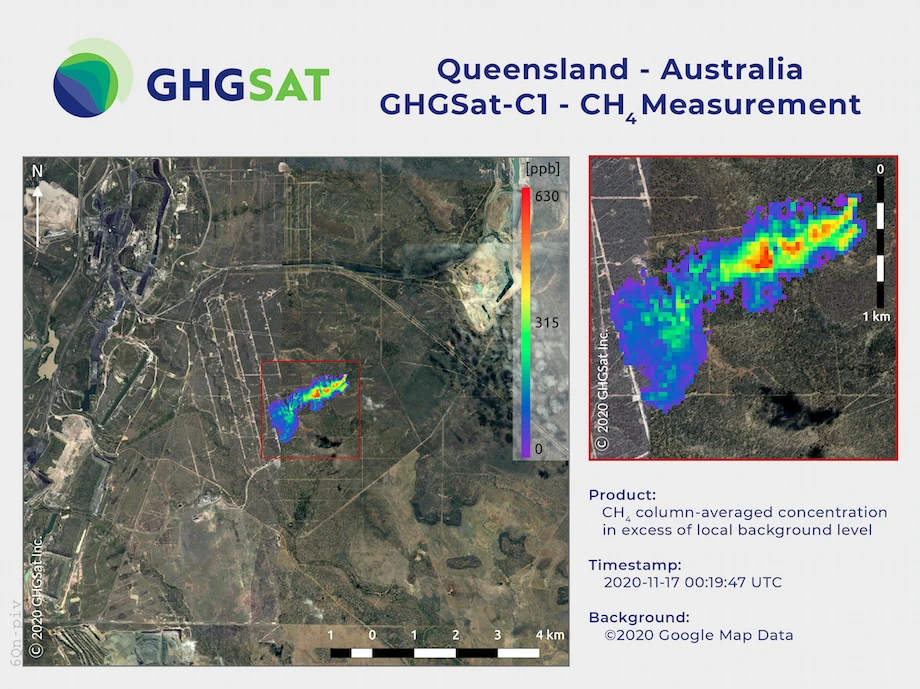

Another niche for companies specializing in satellite monitoring services is environmental protection. Satellite-mounted spectral cameras can be honed in to scan for emissions of carbon dioxide and methane in industrial areas of the Earth.

The top spot in this area is held by Montreal-based GHGSat, which uses spectroscopic sensing technology to spot oil and methane leaks.

GHGSat works with satellites they build themselves, which allows their pricing for sensing services to be more competitive. The sensors from the company ABB installed on GHGSat’s new satellites are able to detect even the smallest leaks, and шт 2020, the GHGSat Oil and Methane Spill Risk Index started to be included on the Bloomberg terminals.

Suborbital tourism and transport

Let’s digress from satellite services and take a look at the blossoming market for suborbital tourism, which has been making huge strides in recent years. Flying into orbit is still an extremely expensive adventure, and is now regarded as a luxury experience rather than a practical way of getting around. However, companies in this sector are doing everything they can to make these flights more economical so that one day, they will be accessible to ordinary people.

2021 was a landmark year for commercial space tourism and will be remembered for a number of successful suborbital missions:

- On May 22, Virgin Galactic made its first space flight on its SpaceShipTwo-class vessel VSS Unity. The ship was piloted by David Mackay and Frederick Sturckow. The crew reached an altitude of 89.24 km, but never crossed the so-called Karman line (over 100 km above sea level), which is considered the internationally-recognized boundary of the beginning of space.

- On July 11, Virgin Galactic launched its VSS Unity spacecraft again, but this time with a full complement aboard: two pilots and four onboard passengers, including the head of Virgin Galactic, billionaire Richard Branson.

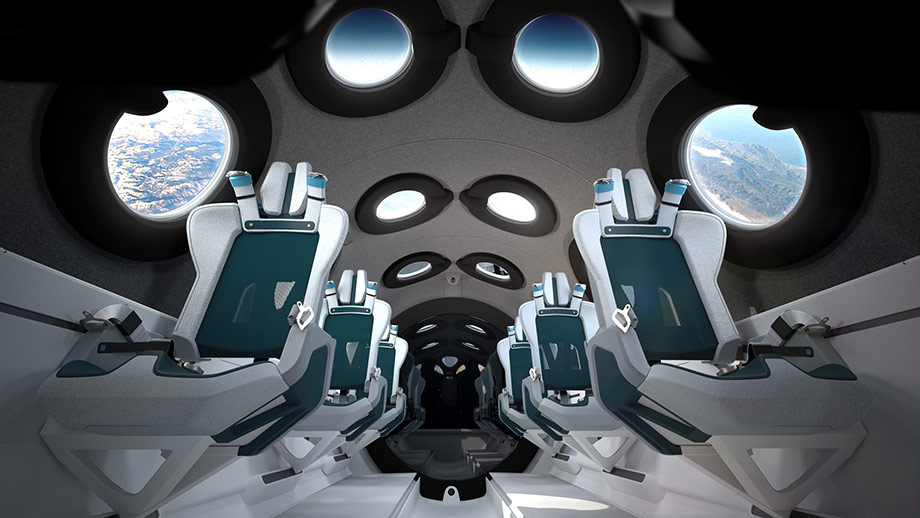

The main goal of the mission was to demonstrate the comfort of commercial flights, as the vessel’s passenger cabin was equipped with comfortable seats and provided everything needed for conducting orbital research.

- On July 20, Blue Origin successfully launched its New Shepard passenger spacecraft as part of the NS-16 mission. The launch took four passengers into orbit, including the Blue Origin head Jeff Bezos, his brother Mark, member of the Mercury 13 Mary Wallace Funk, and Dutch student Oliver Damien. The spacecraft was able to cross the Karman Line, reaching a peak altitude of 107 km above sea level.

- On September 15, Elon Musk’s SpaceX confirmed its ambitions in the field of space tourism. Its mission, dubbed Inspiration4, was the first all-civilian human flight into orbit. The four lay astronauts spent three days in orbit aboard the Crew Dragon Resilience spacecraft. The Crew Dragon was launched by SpaceX’s reusable Falcon 9 launch vehicle. The main objectives of the mission were to study the functioning of the human body in zero gravity, as well as to attract investments of $200 million for the St. Jude Children’s Research Hospital.

- On October 5, a crew of three went to the ISS on board Russia’s Soyuz manned spacecraft. The mission, designated MC-19, was intended to allow for the shooting of a full-length feature film called Challenge, the first in history to be shot entirely in zero gravity. The pilot of the spacecraft was experienced Russian cosmonaut Anton Shkaplerov, while the other two crew members – actress Yulia Peresild and director Klim Shipenko, were not professional cosmonauts. The crew filmed on the ISS for 12 days and then returned safely to Earth.

- On October 13, as part of Blue Origin’s NS-18 mission, William Shatner, known worldwide as the actor who played Captain James T. Kirk on Star Trek, entered orbit. Shatner became the oldest person to ever travel into orbit at the age of 90.

Suborbital flights have the potential to replace long-range air travel in the future. For these purposes, SpaceX plans to use their Starship super-heavy rocket, which can accommodate up to 100 passengers. The company says a Starship flight from New York to Shanghai will be 23 times faster than by plane, cutting travel times from 15 hours to only 39 minutes.

It is worth noting that while suborbital flights are currently the only offering in space tourism, this is not the industry’s only ambition. In the future, this market could expand to extra-planetary tourism to destinations like the Moon and Mars.

Space services market forecasts

A recent study by Allied Market Research predicts that satellite services market value will reach $ 144.5 billion by 2026, assuming it maintains its compound annual growth rate of 2.2%.

The most promising area of the space services market will predictably remain user services. However, the space flight control services sector is unlikely to make any big moves up. The reason is that most major players in the space services industry prefer to independently develop and launch their own spacecraft and satellites.

When it comes to satellite end-users, we can see projected growth in the media and entertainment, defense, and retail industries.

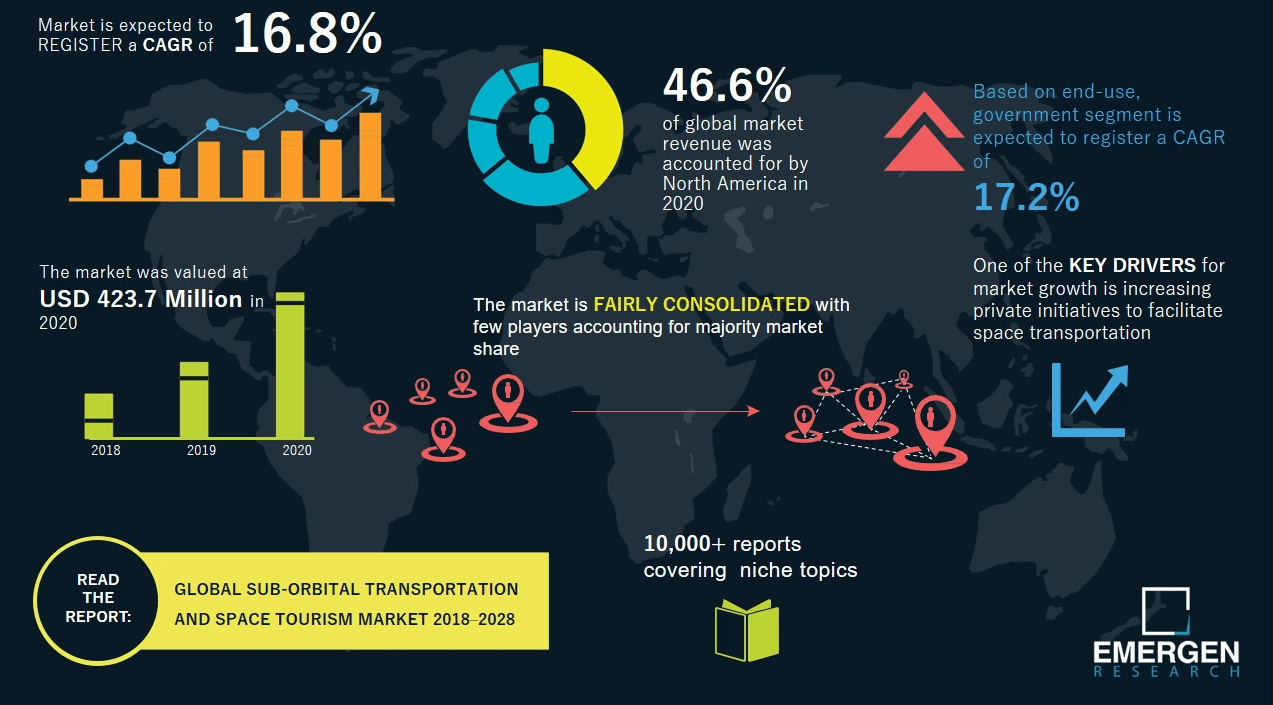

In 2020, the fixed satellite services (FSS) market was estimated at $22.46 billion, and by 2026 its capitalization is set to reach $27.15 billion (if it maintains an average annual growth rate of 5.48%). The growth of this market segment is primarily driven by the expansion of 5G mobile networks.The most impressive growth rates are in the suborbital flights market. According to an October report from Emergen Research, the average annual investment growth in this sector in 2020 was 16.5%, and the market itself was estimated at $423.7 million. If these growth rates continue, then by 2028 the sector is set to skyrocket to $1.45 billion. The most active players on the market remain Blue Origin, Orbspace, PD AeroSpace, LTD, SpaceX, Space Perspective, and Virgin Galactic.

The development of this market is hindered by dwindling public interest in suborbital flight, which is a result of their prohibitively high cost.

Without a doubt, the main factor influencing the growth of the space services market right now is increased demand for Earth monitoring services and geo-exploration of natural resources from industrial companies and environmental organizations. In addition, the media and entertainment industry remains a key market driver, which ensures stable demand for satellite services from satellite TV and radio broadcasting providers and mobile operators.