Today, the industry for the production, launch, and operation of artificial satellites accounts for 75% of the entire New Space Economy market ($271 billion).

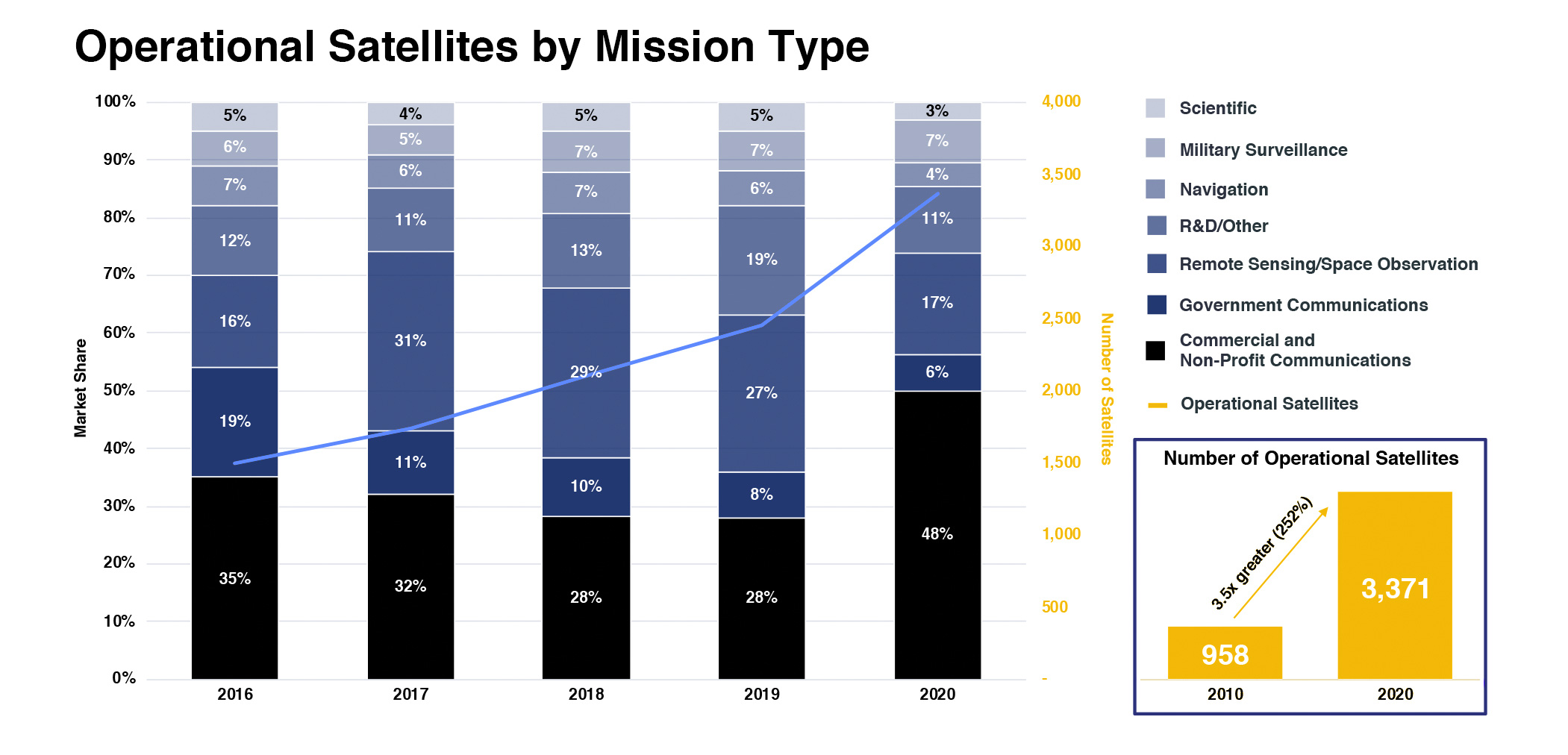

Between 2010 and 2020, the number of satellites operating in Earth’s orbit increased by 252%, from 958 to 3371. By all expectations, this is only the very beginning of a new satellite era. For the implementation of SpaceX’s global high-speed Internet Starlink project alone, 11,943 new satellites are set to be launched into low, medium, and geostationary near-Earth orbits. The Earth’s orbit is becoming increasingly crowded with constellations of compact devices, which are responsible for ensuring our quality of our life. Navigation, communication, and even watching TV in the evening would all be impossible without the help of satellites.

Our editors have prepared a detailed analysis of the tremendously promising satellite industry. We will introduce you to the leading satellite manufacturers and a number of their innovative engineering solutions, as well as try to answer the key questions: “will it start getting cramped in orbit?”

What do satellites do in orbit?

According to the June 2021 State of the Satellite Industry Report, the artificial satellites orbiting the Earth can be divided into 7 main missions:

- Scientific activity, accounting for only 3% of satellites;

- Military intelligence, responsible for about 7%;

- Navigation: the miracle of modern GPS uses just over 130 satellites, about 4% of those in orbit;

- Research and New Development (R&D), accounting for 11% of satellites;

- Remote sensing of space and Earth, with about 17% of all satellites, involves meteorological monitoring, as well as the study of deep space;

- Government communications, making up about 6% of satellites, and used for facilitating encrypted government channels;

- Commercial and non-commercial communications, with the lion’s share at just under half (48%) of artificial satellites.

As can be seen from the graph, in just one year, commercial and non-commercial telecommunications increased the number of satellites launched into orbit by almost 2 times, and this upward trend is set to continue in the next decade, as every year, the market is welcomes new competitive players.

The growing segment of the nano-satellite market and the level of their technological capabilities

The first artificial Earth satellites were quite small. The Soviet Sputnik-1 weighed only 83.6 kg, while the American Explorer-1 that followed it was only about a quarter of that mass, weighing in at only 21.5 kg.

However, at the beginning of the new millennium, the average weight of some communications and surveillance satellites ranged from 2 to 6 tons, while their dimensions were close to those of an average tour bus. The Greek communications satellite Hellas Sat 2, for example, launched into geostationary orbit (GEO) in 2003, weighed 3,450 kg and was launched using the heavy Ariane-5 rocket.

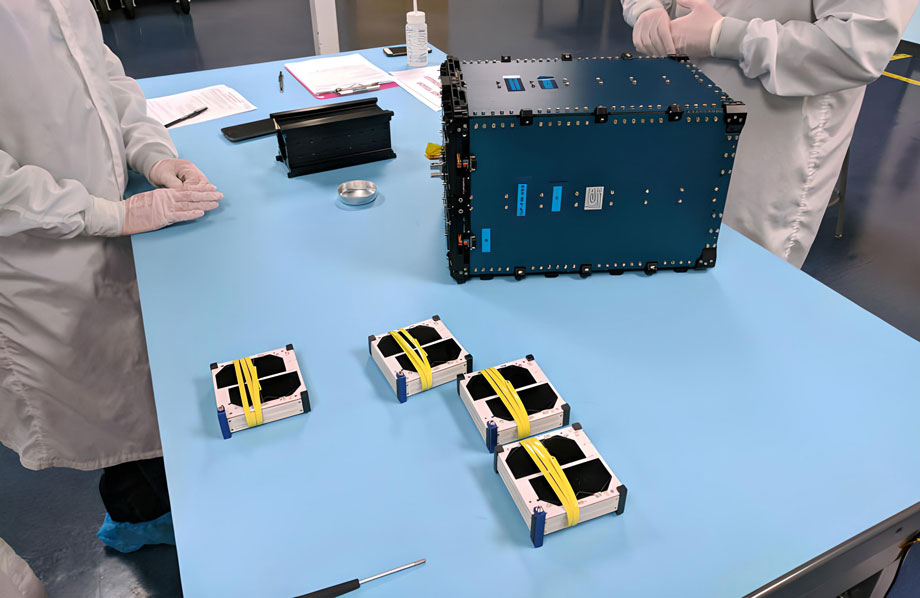

In the last decade, the satellite market has undergone a real revolution in reducing the size of satellites. The result has been the creation of compact nanosatellites (weighing less than 10 kg), cubesats (ultra-small satellites for space exploration weighing less than 2 kg) and pocket cubes (research probes weighing less than 250 grams). The development of ultra-small nano-satellites has become possible as a result of microelectronic technologies being integrated into the process of creating industrial satellites.

The extremely low mass of most nano-satellites allows them to function only in low-Earth orbit (LEO), which results in significant cost reductions for their launch. Their low mass also significantly increases the number of satellites which can be sent into orbit with each launch.

Nanosatellites have paved the way for the formation of “satellite constellations” – groups of satellites launched into orbit and synchronized with each other in order to perform complex tasks. Programmable from control centers back on Earth, these satellites can perform synchronous orbital motion in formation, significantly increasing the accuracy of the data they collect.

The shrinking of satellites has also driven down the costs of their production. As a result, there has been an explosion in the number of commercial companies in the satellite industry today, ready to manufacture, launch, and maintain space satellites at well below astronomical prices.

Companies which dominated the market in 2021 and their innovative technologies

The satellite boom of the last decade has become a reality largely thanks to the efforts of two types of players in the market:

- Young, ambitious start-ups which, upon receiving investments, actually began to prove the efficiency of their business strategies;

- Legacy space giants which most of their funds into the research and implementation of advanced satellite technologies;

Let’s take a closer look at the most notable ones.

Iceye

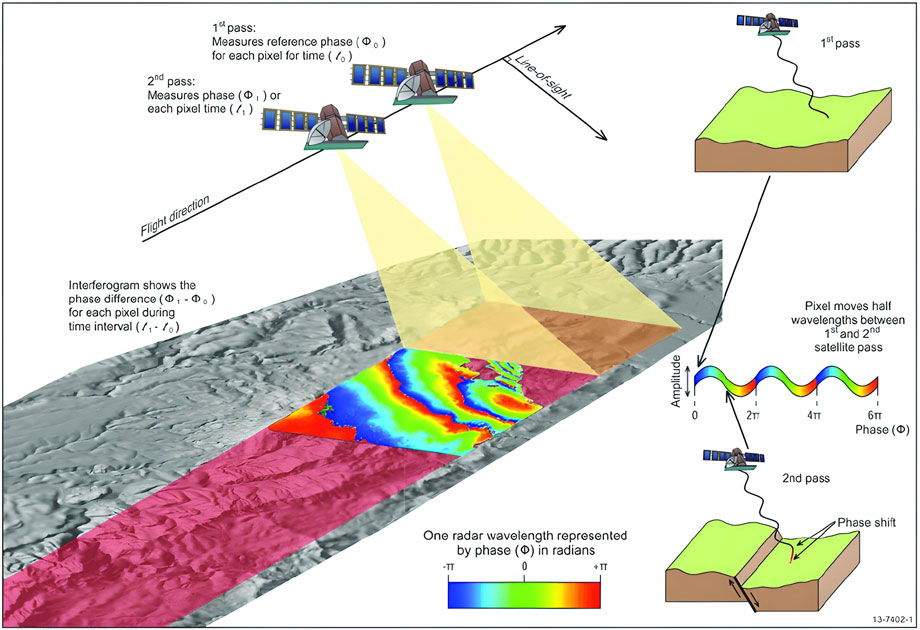

Iceye is a young Finnish startup that entered the market with a vision for satellite weather monitoring and instant response to prevent global cataclysms. Iceye proposes to supercharge forecasting for weather disasters through the launch of its satellites equipped with synthetic aperture radars (SAR).

Thanks to this technology, Iceye’s satellites can collect data actively and in real time, thereby allowing meteorologists and emergency responders to make the best decisions for weather forecasting as quickly as possible. Iceye seeks to use its technology to help contain and clean up disasters like oil spills and floods, as well as to monitor borders. So far, the Finnish startup has already signed a contract with the insurance company Swiss Re. Iceye’s SAR satellites are expected to help improve the forecasting and control of risks from natural disasters, which in turn will help insurers assess damage payouts.

Thanks to great interest from investors, Iceye plans to significantly increase its number of launches starting next year.

Mynaric

Mynaric was founded in 2009 and is headquartered in Munich, Germany. Their specialists are developing technologies for optic inter-satellite links (OISL). This technology, which uses lasers to transmit data,has a number of qualitative differences from radio frequency (RF) transmission. First, unlike RF transmissions, OISL transmissions cannot be drowned out. Second, because the laser light itself is not in an adjustable range like radio is, there is no need for regulatory oversight to make sure that devices stick to an assigned frequency.

Mynaric now is on the verge of a real technological revolution in the field of space data transmission and the creation of super-encrypted communication channels, which has already attracted the interest of a number of government clients. The company has currently signed a number of agreements with SpaceLink (totaling $28 million) and Cloud Constellation (an undisclosed amount). In addition, the company is partnering with the US Department of Defense’s Defense Advanced Research Projects Agency (DARPA) on their Blackjack project. It is expected that the standards Mynaric is developing for space laser communications will become nationwide in the United States and a number of other developed countries.

Spire

Spire is one of the few companies today that has its own functioning satellite constellation, with theirs totalling over 100 devices). The company operates under the Satellite-as-a-Service model and provides its clients with services for radio frequency monitoring and data collection from the Earth’s surface. The Spire constellation is a popular provider of aviation and marine navigation services, as well as a collector of weather data. Spire’s most famous customers today are NASA and American jet manufacturer Aerion Supersonic.

The sensors on Spire satellites can be programmed from Earth-based command centers. This provides higher quality data collection, depending on the type of study area. Last year, Spire’s revenues topped $36 million, and the company’s total market capitalization is projected to reach $1 billion in 2025.

Swarm

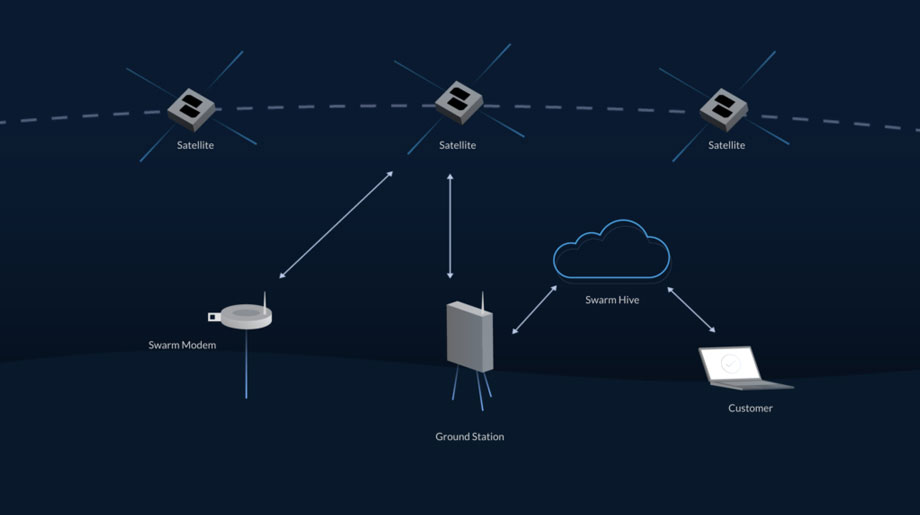

Swarm is another company that has successfully launched a constellation of nano-satellites (about 100) into orbit. It provides customers with the ability to connect to the Internet of Things (IoT), a fully-automated data transmission network that minimizes the participation of human operators in technological processes. Swarm’s nano-satellites are uniquely small, measuring only 11 x 11 x 2.8 cm and weighing in at only 400 grams.

Swarm itself manufactures an entire vertical of technical equipment needed to provide a data transmission network: from communication satellites to modems and ground control stations. Thanks to this vertically integrated management system, Swarm’s prices for providing communication services are on average 4-16 times lower than those of their direct competitors (their average monthly price for access to IoT is around $500, while other providers charge in the range of $10,000). For individuals, the price is as low as $5 per month (not including the purchase of necessary network equipment).

Thales Alenia Space

Thales Alenia Space, a Franco-Italian company founded in 2007, is a true veteran of the market and is currently one of the largest satellite manufacturers in Europe. Thales Alenia Space kicked off 2021 with a major contract with Teleast to launch 298 Lightspeed satellites into orbit, creating a new constellation of satellites to provide high-speed telecommunications services. The deal with Telesat is not the only big project on the Thales Alenia Space docket. In cooperation with the South Korean telecom operator KT SAT, the company plans to launch a Koreasat 5A satellite into geostationary orbit, the main task of which will be to extend 5G network connections to hard-to-reach regions of Korea.

Corporate titans like Microsoft are also using the advanced developments of Thales Alenia Space. The company’s DeeperVision software will soon be added to the platforms of Azure Orbital, a service from Microsoft which provides customers with the ability to transfer satellite data to cloud storage for subsequent processing. DeeperVision can accelerate this process significantly with its capacity to automatically organize and filter satellite data as soon as it is captured.

Thales Alenia Space also helps advance scientific research. The company is currently taking part in a European Commission initiative to design, develop and launch a new European satellite communications system, the name of which has not yet been released.

LeoLabs

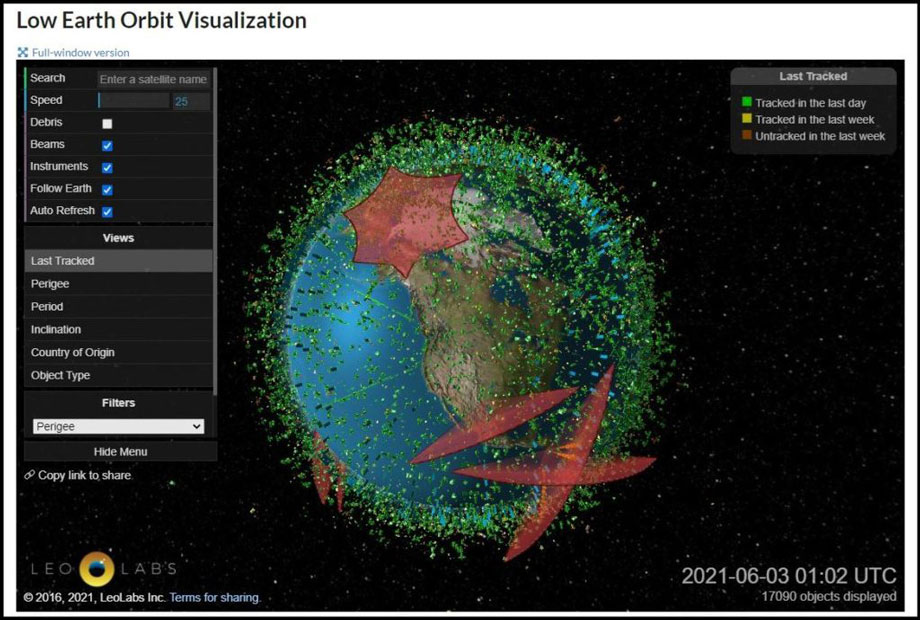

LeoLabs has been a favorite of satellite industry investors for several years, ever since they took the top prize at that year’s SATELLITE 2018’s Startup Space competition. Their main work is the creation of a ground-based controlled Space Situational Awareness system (SSA). This system provides control and systematization of low-Earth orbit, which is the planet’s most congested orbital zone. Without the traffic and debris accumulation tracking information provided by Leolabs’ SSA, an orbital collapse in satellite navigation would be a matter of hours. Today, LeoLabs is the most reliable protector of the satellite industry’s orbit-based assets.

LeoLabs is currently building a new radar near the equator in Costa Rica. It will be able to provide a wider range of orbital monitoring than its predecessors. Over the past year, the company has been able to attract more than $65 million in new investments, and its total capitalization for 2021 is estimated at $100 million.

Astroscale

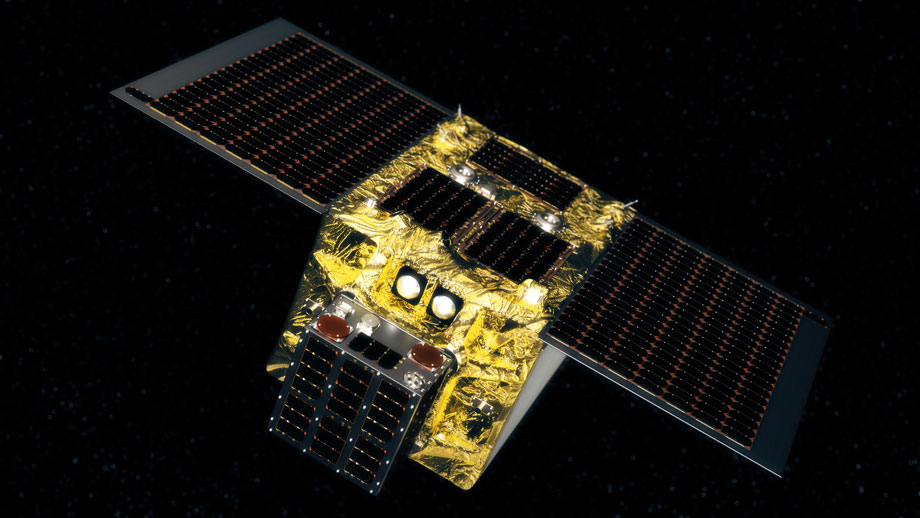

Last but not least is Astroscale, a Japanese startup founded in 2013. Their main focus is on containing and eliminating orbital debris. Their debris removal spacecraft ELSA-d (End-of-Live Services by Astroscale) was successfully launched this year. Over the next few months, the satellite will collect space debris and demonstrate its effectiveness to potential investors.

The head of the company, Nabu Okada, has chosen perhaps the perfect moment to bring his technology to life. While industry giants like SpaceX, Telesat, and Amazon have announced highly ambitious satellite plans to launch their constellations into an already congested low Earth orbit, Mr. Okada and his company are the only ones trying to make sure things don’t get dangerously crowded.

Analysis of the Satellite Industry and its Near-Term Prospects

The global satellite industry is now in the midst of robust growth, primarily driven by increased demand for Direct to Home (DTH) television, as well as the growing demand for high-speed network data transmission in developed countries. Another important component driving up demand for satellite services is the chance to set up super-encrypted communication channels, which is drawing the active interest of governments and the defense industry.

The main constraints on market growth right now are growing competition from companies providing fiber-optic communication services, as well as a number of serious financial risks of launch failures. In addition, the problem of congestion in low near-orbital space remains important and not fully resolved, especially in consideration of the skyrocketing number of micro and nanosatellites currently and planned to be in orbit.

One way or another, this segment of the satellite industry will provide a stable average annual growth rate of 6.4% at least until the end of 2025. Let’s hope that the rise in revenues of this segment of the space market will be followed by a corresponding increase in the consciousness of its key players in terms of creating a safe and clean orbital space.