The trends which emerged in the space market in the first quarter of 2023 had been anticipated by experts in advance: a reduction in the market for small rockets, an increase in demand for small satellites, along with the deployment of large constellations of communications satellites and the implementation of ambitious space programs such as Artemis. However, security issues have come to the fore both in Europe and in the United States, and it is military and government orders that are shaping the market trends for 2023.

In this report, analysts from Noosphere Ventures lay out the main events of the beginning of 2023 and review the main trends in each corner of the space market.

The rocket market remains overheated

The small rocket market continues to overheat from the domination of major players such as Lockheed Martin and SpaceX, and the general tendency of customers to get services from them. Therefore, most players in this market are striving to diversify their production: to create engines or components, but not launch rockets themselves.

SpaceX’s Starship

Thus, while being quite successful in the small rocket market, Rocket Lab is increasingly shifting its focus to the production of satellites. The company’s latest report indicates that its manufacture of space systems brough $150 million in profit, making up 71% of the company’s total profits.

Another example is the American company Astra Space, which despite reporting 278 orders for its engines, showed a drop in value by $ 411 million and no profit in the last quarter of 2022.

The main negative event of Q1 2023 in the small rocket market was the bankruptcies of two companies at once: Virgin Orbit and the Canadian company SpaceRyde. SpaceRyde is facing a funding shortfall due to the failure of its projects to reach technological maturity and an unrealistic business plan. Virgin Orbit, on the other hand, already had proven technologies and successful launches, but despite these advantages, investors would not open their coffers to them, given the situation in the small rocket market and the instability of the banking sector.

At the same time, SpaceX announced its readiness to carry out 100 launches this year (up from 61 launches in 2022). Since SpaceX has the lowest launch prices, the company is well within its means to achieve its goals. This also confirms the general trend of 2023 towards an increasing number of launches, despite the exclusion of Russia from Western markets due to its war against Ukraine.

Another trend in 2023 that can be observed is a general desire by Europe to attain independent satellite launch capacities. Dependence on Russia in this matter in previous years caused a number of European countries to postpone or even cancel planned launches once Russian aggression forced their cancellation, or to turn to American service providers.

That is why European countries like Great Britain, Germany, Spain, and France are actively working to stimulate the development of local rocket companies which in the future could take their place in the market for small and medium-sized rockets.

Contracts, launches and failures

A number of companies distinguished themselves In the first quarter of 2023. Jed McCaleb’s company Vast, acquired Launcher in order to accelerate its space station project, and ABL Space Systems won a $60 million contract from the US Space Force to be ready to carry out tactical space operations.

Concept art of the Vast space station. Photo: vastspace.com

The top attractors of investment were Germany’s Isar Aerospace ($165 million) and Japanese Interstellar Technology ($42 million), with the American Vaya Space coming in third with $12 million.

It was European space companies that demonstrated the most confident trend in growth and raising capital in Q1 2023, as well as a positive trend in the development of their own technologies. France’s Latitude and Skyrora from the UK are particularly worthy of note. Both companies have already completed the first successful tests of rocket engines of their own design, and Skyrora received support from the European Space Agency (ESA) through the Boost! program.

Unfortunately, the beginning of 2023 was also marked by high-profile failed rocket launches. The most notorious was no doubt the launch of LauncherOne from Virgin Orbit, advertised as the “first from the UK.”. The rocket failed to reach orbit due to a failure in one of its second-stage engines.

The first launch of the RS1 rocket from ABL Space also ended in failure. About ten seconds into the flight, the rocket completely lost power, which led to the shutdown of all nine engines at an altitude of 232 m.

The first launch from Relativity Space had a much better result. Its 3D-printed Terran 1 rocket was able to take off from the launch pad, reach the point of maximum pressure, was only prevented from entering orbit on the company’s first attempt by a malfunction in the second stage system. Considering that the main task was to demonstrate the strength of 3D-printed components and the ability to withstand high stresses, the launch can be called a significant success.

Lunar plans

One thing that has remained unchanged in 2023 is the fact that the Moon has remained of interest only to government agencies. All contracts for the creation and maintenance of orbital lunar flights or landing modules have been given to private companies only within the framework of state programs.

Currently, there is only one startup, Astroforge, with plans to launch a monitoring satellite into lunar orbit. However, given the company’s main goal – the commercial extraction of minerals from asteroids – and the fact that its plans remain only on paper, it remains rather doubtful that they will soon achieve their ambitions.

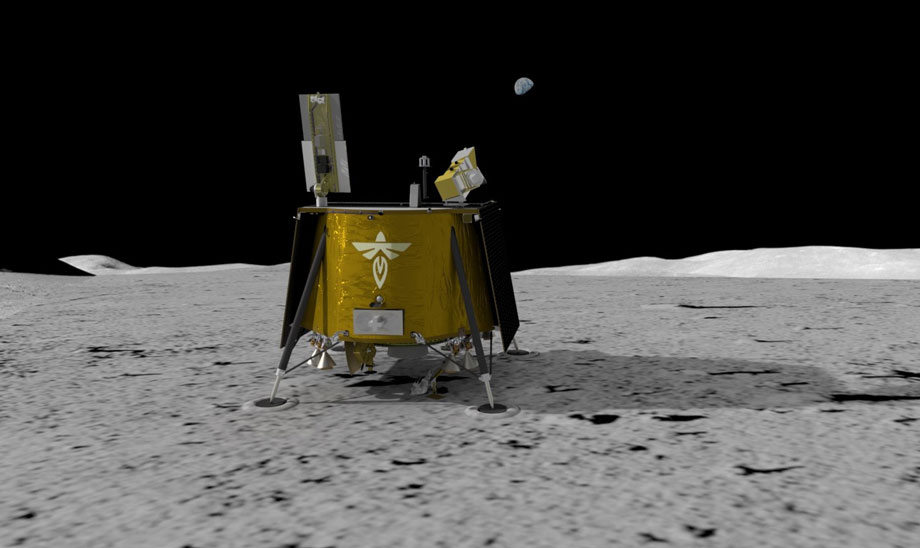

The largest contract in the space industry for Q1 2023 was awarded to Firefly Aerospace, founded by Ukrainian entrepreneur Max Polyakov. This is the second contract for the launch of the lunar lander, this time for $112 million. The launch is scheduled for 2026.

Firefly Aerospace’s Lunar lander. Photo by NASA

Note that both NASA and the ESA have been faced with budget overruns for their lunar programs. NASA had a 25% increase (from $1.5 billion to $1.9 billion) in the budget for the Artemis HLS mission to land astronauts on the surface of the Moon, and transferred the funding for its water mapping program on Mars to the same mission for the Moon.

The European Space Agency cut its deep space mission funding program from €931 million to €886 million following the cancellation of the ExoMars and Luna-27 space missions. Thes were the programs that included participation from Russia’s Roscosmos, but cooperation was completely halted as a result of Russia’s aggression against Ukraine.

Small satellite dominance continues

In the satellite manufacturing market, small companies retained their dominant position in terms of the number of orders, mainly due to their use in telecommunications and monitoring satellite constellations. Orders for the first quarter of 2023 included: one large observation satellite, two medium ones, seven cubesats, and 334 small satellites. Of these, only 19 orders came from the public sector, with the rest being ordered by private companies, including 300 satellites that will become part of the new Rivada Space Networks communications constellation.

The largest order, namely for the 300 Rivada Space Networks satellites, was received by by the US’s Terran Orbital. The $2.4 billion contract is to be completed by 2026, and will represent half of a planned 600 communications satellites.

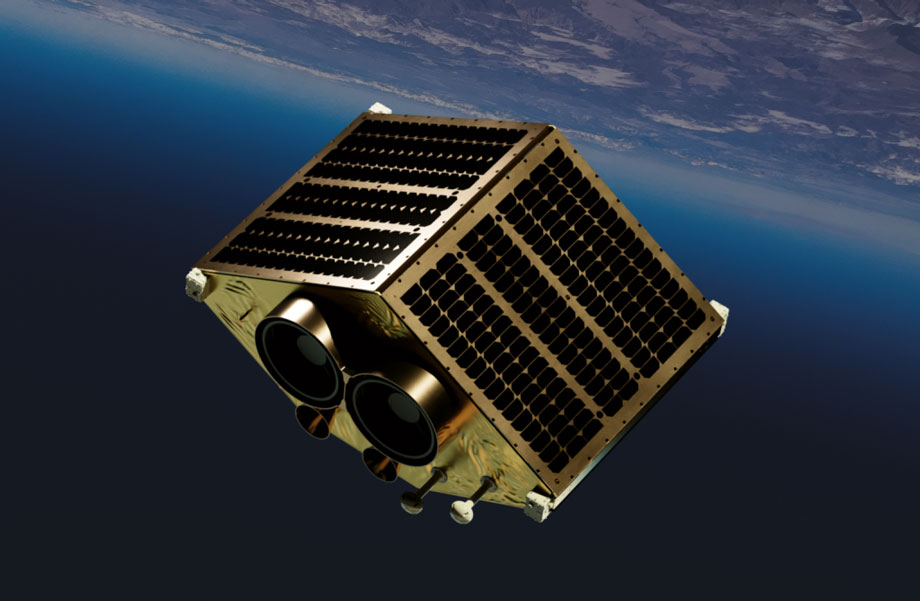

It is also worth noting the launch of the first satellite from the EOS SAT constellation from EOS Data Analytics, aimed at serving the needs of the agricultural sector. EOS SAT-1 was launched on January 3, 2023. It is a small optical satellite equipped with a powerful camera from Dragonfly Aerospace, although future parts of the constellation will include SAR satellites.

EOS SAT-1 Satellite. Photo EOS Data Analytics

Satellite needs determined by government agencies

In the Earth observation niche, the main trends are being set by government agencies, as it is their orders that determine the main priority of the niche: multisensory constellations, a combination of optical and SAR technologies which are primarily of interest to military customers.

Thus, the British Ministry of Defense announced the creation of the ISTARI constellation (SAR + optics + RF), Italy continues to develop its IRIDE program, and in the US, the National Reconaissance Office is interested in the combined data that five private American companies will transmit to it simultaneously.

In addition, there is also a growing demand in the Earth observation niche from commercial companies. Thus, BAE Systems is developing a combined Azalea constellation (which could potentially be used for reconnaissance), while Satlantis and ICEYE are developing the Tandem4EO SAR + optical constellation for civilian and military needs.

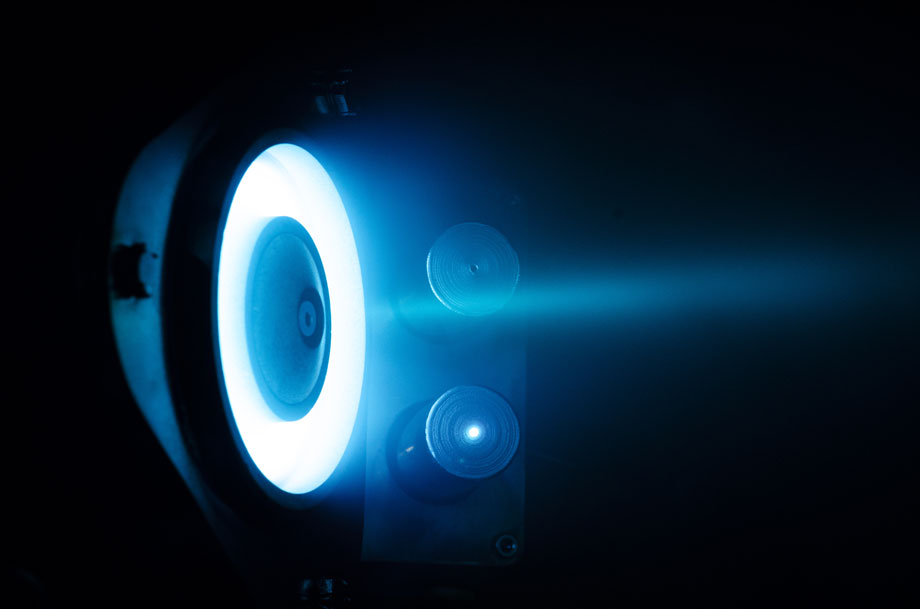

The world is moving to electric motors

In the market of engines for satellites and transport systems, the demand for more economical electric motors is steadily growing. Q1 2023 saw the first serial orders for electric satellite engines appear. Analysts have been waiting for this event for a long time, and it seems that this year will finally bring an increase in the number of orders.

The largest order was received by EuropeanImpulse, which will create 12 electric engines for satellites of the IRIDE constellation. In the same time, the development of the American Busek will replace the Fakel engines on OneWeb satellites, as a result of which the company will double its production capacity.

Successful real-world tests were conducted by SETS, whose engine has already passed all tests and is running on the EOS SAT-1 satellite.

SETS’s Hall Thruster. Photo SETS

This year, several companies are planning to conduct initial tests of their electric motors and start fighting for orders. Among them is the Spanish Ienai Space, which has not yet tested its system in space, but will still likely be producing eight engines for the Atlantic Constellation.

In the second quarter of 2023, we are waiting for important space launches for NewSpace, new high-profile deals, and major rounds of investments. Noosphere Ventures analysts will keep a keen eye on the main market events and analyze possible changes in trends in both the private and public space sectors.