In the first part of our article about the year’s results, we talked about the three, in our opinion, most important space missions of the passing year. In this piece, we will digress from the missions that have already happened to focus our attention on analyzing the main trends in the space industry, which took shape in 2022. They set the necessary vector of the space sector development in the passing year.

Cosmodrome construction: demand creates supply

The success of the DART, JWST, and Artemis I space missions we discussed in the first part of this article would never have happened without the help of launch vehicles produced by such gigantic companies as SpaceX, Arianespace, Northrop Grumman, and Boeing. Nevertheless, at the end of 2022, it is becoming increasingly clear that the era of monopoly companies like SpaceX is slowly dying out. Space today is a playing field for everyone.

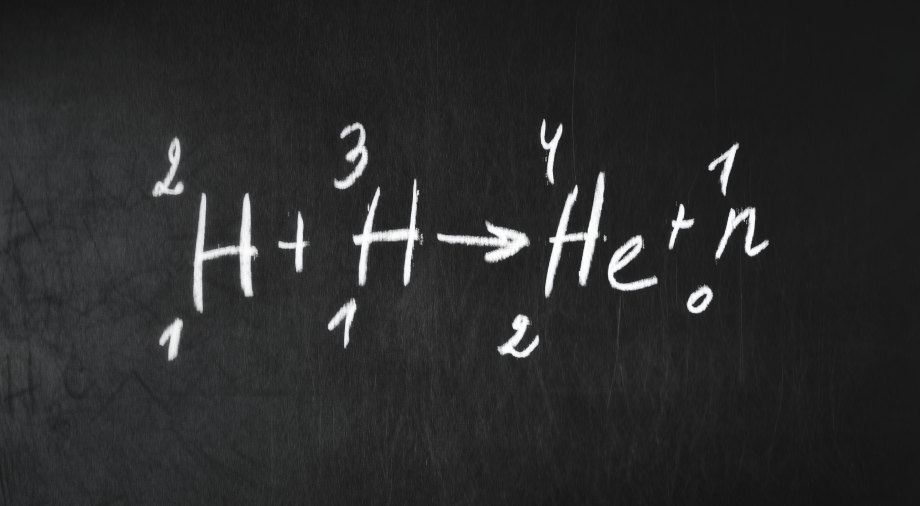

Just look at the increase in the construction of new spaceports that we have seen this year. In the UK alone, seven are expected to appear shortly. The future launch pads will likely adapt to vertical and horizontal launch needs.

Source: UK Space Agency

Foggy Albion has never had the autonomy to launch its own space missions. Thus, it has launched them from sites in France, Russia, and South America. Britain is now ready to launch the first space mission from its land. The Cornwall Cosmodrome, which opened this summer, will be the launch site for the LauncherOne space rocket from a Boeing 747 Cosmic Girl, modified by Virgin Orbit to launch ballistic missiles.

As soon as the British Virgin Orbit mission is a success, the process of establishing Britain as a new space power will be complete. The Boeing 747 Cosmic Girl launch from Cornwall was supposed to take place in mid-December, but due to the delay in issuing a license to place payloads into orbit, Virgin Orbit was forced to postpone the launch again. Most likely, the historic event for the British will be held early next year.

Obviously, the main purpose of constructing new British space launch facilities is the desire of the country to get the status of a leading space power, able to meet its own needs in infrastructure for space launches.

The second reason for building new space launch sites is economical. It is associated with the increased demand for new space launch sites, which comes from new private aerospace companies, both European and British. The UK’s exit from the EU, which ended in 2020 and was called Brexit, significantly chilled the relationship between British space and the ESA (European Space Agency).

Now, with the emergence of new launch sites, there is the hope of restoring former contacts. Europeans have something to launch into orbit, but the number of space launch sites in Europe can still be counted on the fingers of one hand. As things stand, Britain’s services in infrastructure for space launches could come in handy.

Private launches: The importance of working on mistakes and new types of methane rockets

In the Foggy Albion itself, there are also enough potential users for actively built spaceports. One such company is Scotland’s Skyrora, which has ambitions to gain a foothold in the private rocket company market in the next few years. The company plans to create a line of launch vehicles focused on launching payloads into different Earth orbits.

On Oct. 13 of this year, Skyrora made its first attempt to launch its Skylark L rocket from the Langues Peninsula launch site in Iceland. Despite a successful launch and vertical liftoff, the rocket failed to reach the declared altitude threshold of 100 km, thus resulting in the failure of the mission.

This was just the first launch of Skylark L, but we are confident that subsequent launches will be successful, especially since there were similar examples in the space launch industry in 2022. Firefly Aerospace, which also failed to put a payload into orbit during the first launch of its two-stage Alpha rocket on September 3, 2021, was able to learn from the failure. On Oct. 1, 2022, the company made a second launch attempt from Vandenberg Space Force Base, Calif, and this time successfully.

Firefly Alpha launched several NASA research microsatellites into low earth orbit (LEO), particularly the TechEdSat-15 spacecraft, to demonstrate a new orbital exo-brake technology that would help quickly bring satellites down from orbit in the future. The rocket also carried a satellite bus from the Libre Space Foundation, which housed five PocketCube cubesats. The success of Firefly Aerospace’s second rocket launch illustrated the importance of sorting out one’s mistakes.

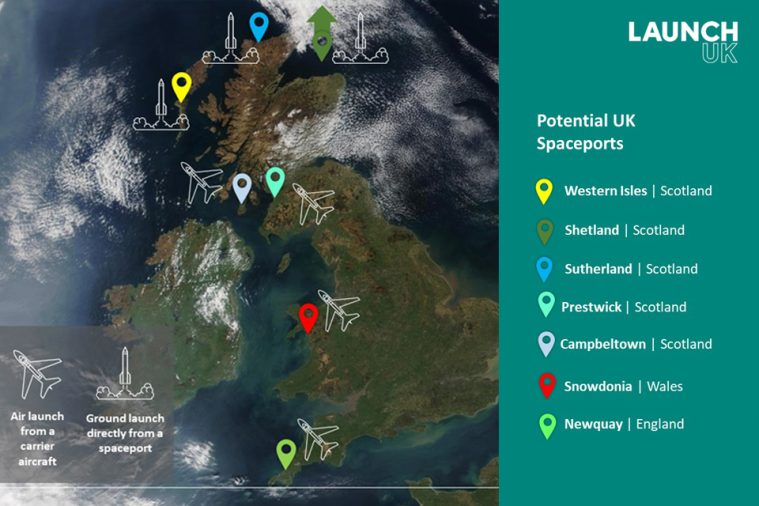

Such work on mistakes will soon come in handy for the Chinese company Landspace. On December 15, this company was able to carry out the first launch of its Zhujue-2, a methane-fueled rocket that uses oxygen as an oxidizer. The new type of rocket engines powered by liquefied methane could revolutionize the field of re-entry vehicles, as they would be a more powerful and cost-saving way to deliver payloads into orbit.

China’s Landspace mission could be the world’s first successful methane rocket launch, but that honor is now likely to go to other players. Such companies as Blue Origin (the New Glenn rocket), ULA (the Vulcan rocket that uses the New Glenn engine as well), and SpaceX (the fully re-entry vehicle Starship) are already building their methane-oxygen-powered rockets.

Many of these rockets are expected to reach orbit as early as 2023, but even now, when we haven’t yet seen a single successful methane rocket launch, we can state that modern re-entry rockets have revolutionized the rocket launch market. It is the development of return and part-return technologies (where only some stages return to Earth) combined with the continuing drop in the price of delivering payloads to orbit. That has turned into what, by the end of 2022, should be called nothing less than “The LEO orbit boom.”

Active conquest of LEO orbit

By the end of 2022, the most extensive satellite constellation in orbit remains Starlink from SpaceX. Currently, it has over 3300 satellites. The company is going to bring this number up to 12000, with a possibility of further expansion of this constellation up to 42000 satellites in low Earth orbit.

Much of these results have been achieved by SpaceX ability to use the resource LEO competently – the orbit is lower, which means it’s easier to put payloads on it. Combined with the availability of return rockets such as the Falcon 9, SpaceX quickly put on stream launches of its vehicles at LEO. The Starlink constellation adds an average of 40 spacecraft per launch.

The increase in LEO launches marked the beginning of a new era of space commercialization that will become even more discussed throughout the next decade. Telecommunications, monitoring, and meteorological satellite constellations are increasingly placed in LEO orbit, where, when working coherently, they can provide a large coverage area of terrestrial fields, guaranteeing the end user a fast satellite signal transmission (here, the low altitude ceiling of the orbit plays a role) and its high stability (each constellation satellite is ready to replace another in case of its failure).

The growing number of spacecraft, satellites, and cubesats launched into LEO orbit significantly expands the range of services they can provide. Political instability caused by Russia’s attack on Ukraine earlier this year (to which we will return below) has exacerbated the situation in the food market. The blockade of trade maritime routes by Russian ships led to a situation in which millions of tons of grain destined for export stood idle in the ports of one of the most agricultural countries in Europe. The shortage was immediately felt by the inhabitants of some countries of the African continent, as a result of which the local food crisis grew into a global one in a matter of days.

In the current food market instability, agricultural satellite monitoring missions started to play an active role. Their main goal was to increase crop yields through remote sensing methods and subsequent analysis of the collected data with the connection of artificial intelligence (AI) systems. One such company was the EOSDA, which in early 2023 launched the first constellation of seven satellites for agro-monitoring of croplands from orbit.

The SAT-1 monitoring satellite, manufactured by DragonFly Aerospace, is based on the µDragonfly satellite bus, which carries two DragonEye optical modules. The SAT-1 optics will be capable of surveying 11 spectral bands, and the coverage of the final satellite constellation will be about 100% of the area of the 20 largest agrarian countries of the world.

Obviously, betting on the usage of monitoring satellites in the agricultural sector is betting for the future. It is the contribution of companies such as EOSDA to the technology development today that ultimately brings this leap closer. Future constellations of agricultural satellites will contribute to new economic and high-yield farming methods, in which orbital observations will play a key role.

The low gravity (microgravity) conditions in low Earth orbit open the way for new scientific missions. This could be rather useful for scientific research in healthcare. A recent study by McKinsey & Company claims that pharmaceutical companies willing to conduct their clinical trials in microgravity, if successful, can expect to increase their profits by anywhere from $2.4 to $4.2 billion per year.

This year, some Earth Observation (EO) satellite missions operating in LEO orbit contributed to another mission not previously available to commercial satellites – defense. Commercial EO companies took a proactive stance to provide Ukraine with up-to-date intelligence regarding the movements of Russian occupying forces. This was the first precedent in the history of space when private commercial companies decided to contribute to the process of geopolitical crisis management.

The war in Ukraine: The role of commercial EO companies in global security

Russia’s full-scale invasion of Ukraine began on February 24, 2022, and did not follow the Russian scenario from the beginning. The main reason for this was the high level of awareness of the advance of Russian units to the state border of Ukraine. A number of aerospace companies providing satellite monitoring services began to signal preparations for intervention.

The first harbingers of the Russian invasion were satellite images of the company Maxar, which began to record the first activity of the Russians in building up their military infrastructure near the Russian-Ukrainian border several weeks before the invasion.

Source: Maxar Technologies

On February 24, 2022, Maxar satellites had already observed multi-kilometer columns of Russian equipment marching toward Kyiv. This information helped Ukrainian forces track the strategic movements of the invading troops and react on the ground, meeting and destroying the occupying forces’ equipment and staff. The collaborative work of satellite intelligence, on the one hand, and the Ukrainian military, on the other, resulted in the expulsion of the Russians from the entire northern territory of Ukraine within a few months. Private satellite companies celebrated their success, and leading Ukrainian public figures and entrepreneurs appealed for increased provision of up-to-date satellite intelligence to the country.

Ukrainian businessman Max Polyakov, head of EOSDA, made his appeal to a number of EO companies, in particular: Iceye, Capella, Planet, MAXAR, Airbus, SIIS, Space View, and Blacksky. He called for closer coordination and the importance of providing Ukraine with data from Synthetic Aperture Radar (SAR) satellites. SAR satellites could make observations using radio-wave surface sensing, allowing experts to track occupant movements regardless of weather conditions or time. By August 2022, thanks to Poliakoff’s participation, Ukraine acquired the Iceye SAR satellite from the Finnish company of the same name for its personal use.

EO satellites played an important role in combating not only Russian technology but also Russian propaganda. Satellite imagery provided clear evidence of lies from the Russian General Staff and the media. For example, the August orbital images provided by the Planet Labs monitoring satellites showed the real picture of the results of the Ukrainian attack on the Russian airbase in Crimea, damage from which the Russian government tried to hide from the world community and its citizens so desperately.

Source: Planet Labs PBS/Reuters

Ukraine’s war can be the first war in history when the commercial space sector is actively involved. The trend of supporting Ukraine from space will likely continue next year: over the past 16 years, the number of private satellite monitoring companies has grown from 11 in 2006 to over 500 in 2022. More than 70% of these companies are based in the United States, Ukraine’s most influential ally in this war.

The determined stance demonstrated by a number of private satellite companies made it clear that commercial space can not only fulfill private orders but also become a global security concern if necessary. In 2022, the space sector demonstrated that it could be autonomous, sustainable, productive, and, in the case of a response to global threats, responsible and decisive.